5Paisa Share Price Target 2026: 5Paisa is one of the leading Discount stockbrokers in India. It is a subsidiary of IIFL, which provides investment facilities through its Demat account in Equity, Derivatives, Mutual Funds, and IPO. The company was founded in 2007 by Prakarsh Gagdani and Nirmal Jain, and its Current CEO is Nirmal Jain. 5Paisa was listed on the stock exchange on 16 November 2017.

| Current Price | ₹347.95 |

| 52 Week High | ₹487.70 |

| 52-Week Low | ₹287.65 |

| Fear & Greed Index | Neutral |

| Sentiment | Neutral to Bearish |

| 50-Day SMA | ₹316.1 |

| 200-Day SMA | ₹362.3 |

| 14-Day RSI | 49.5 |

Current Overview of 5Paisa

| Market Essentials | Values |

| Market Cap | ₹ 1,064.43 Cr |

| No. Of Shares | 3.12 Cr |

| P/E | 22.59 |

| P/B | 1.7 |

| Face Value | ₹ 10 |

| Book Value | ₹ 200.71 |

| ROE | 12.13 % |

| ROCE | 13.55 % |

| Profit Growth | 31.37 % |

| Sales Growth | -8.86 % |

| Dividend Yield | 0 % |

Recent Performance 5Paisa Capital Ltd.

Due to the trade war and fear sentiment in the market currently, we can see a bearish sentiment in the market with a high selling volume. If we look at the performance of 5Paisa stock in the past year, we will see that it continues to fall. In March 2025, we can see a big volume, and it’s closing with a green candle. As per analysts, we can see positive growth in the upcoming months.

| In Long Term | In Short Term | ||

| Duration | Return in % | Duration | Return in % |

| 1 Year | -27.68% | 1 Month | 1.63% |

| 2 Years | -37.22% | 3 Months | -5.88% |

| 3 Years | 10.13% | 6 Months | -15.32% |

| 5 Years | 14.93% | 9 Months | -13.31% |

5Paisa Share Price Target 2026 To 2040

As per operating income growth and EPS growth, the company’s financials are very stable in the upcoming years. We can see upside momentum in the company. In the past 5 years, the profit growth of the company has been positive, and its income growth has increased every year; these fundamental factors are good for any stock in the long term.

| Year | Share Price Target |

| 2026 | ₹460 |

| 2027 | ₹390 |

| 2028 | ₹473.65 |

| 2029 | ₹610.15 |

| 2030 | ₹780.85 |

| 2035 | ₹982.79 |

| 2040 | ₹1642.90 |

Also Read- Jio Finance Share Price Target

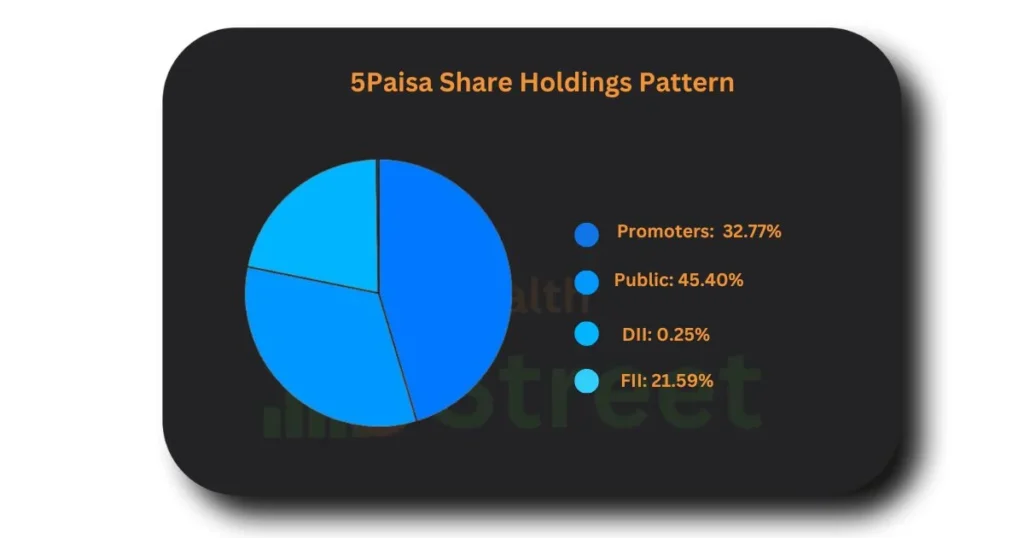

5Paisa Share Holding Pattern

If we see the shareholding pattern of 5Paisa stock, 32.77% of the stock is held by its promoters, 46% of its shares are held by the public, and 22% of the shares are held by FII, where only 0.0% of the shares are held by DII and mutual fund houses.

5Paisa Share Price Target 2026

As per analysts, moving average and technical indicators show bearish sentiment in the short term for 5Paisa stock, but in the long term, because of company fundamentals, it shows growth potential in this stock company, continuously making profit since the last 3 years, the expected Price Target of 5Paisa Share in 2026 can be ₹460.

Since the start of 2026, the market has shown a continuous decline. The year 2026 seems bearish for the Indian stock market. In April, due to the reciprocal tariff, a trade war started between many countries. Due to this trade war, we see sharp falls in most of the stocks, as well as global Indices.

| Month | Share Price Target |

| January 2026 | ₹ 345.07 |

| February 2026 | ₹ 362.11 |

| March 2026 | ₹ 376.50 |

| April 2026 | ₹ 387.50 |

| May 2026 | ₹ 398.65 |

| June 2026 | ₹ 365.80 |

| July 2026 | ₹ 395.32 |

| August 2026 | ₹ 422.91 |

| September 2026 | ₹ 447.40 |

| October 2026 | ₹ 451.03 |

| November 2026 | ₹ 439.10 |

| December 2026 | ₹ 460 |

5Paisa Share Price Target 2027

| Month | Share Price Target |

| January 2027 | ₹ 455.08 |

| February 2027 | ₹ 447.10 |

| March 2027 | ₹ 451.60 |

| April 2027 | ₹ 465.80 |

| May 2027 | ₹ 432.02 |

| June 2027 | ₹ 428.15 |

| July 2027 | ₹ 439.07 |

| August 2027 | ₹ 425.62 |

| September 2027 | ₹ 419.95 |

| October 2027 | ₹ 408.54 |

| November 2027 | ₹ 401.09 |

| December 2027 | ₹ 390 |

5Paisa Share Price Target 2028

| Month | Share Price Target |

| January 2028 | ₹ 397.08 |

| February 2028 | ₹ 403.86 |

| March 2028 | ₹ 417.75 |

| April 2028 | ₹ 429.08 |

| May 2028 | ₹ 436.54 |

| June 2028 | ₹ 425.61 |

| July 2028 | ₹ 441.88 |

| August 2028 | ₹ 459.05 |

| September 2028 | ₹ 442.69 |

| October 2028 | ₹ 463.11 |

| November 2028 | ₹ 475 |

| December 2028 | ₹ 473.65 |

5Paisa Share Price Target 2029

| Month | Share Price Target |

| January 2029 | ₹ 481.70 |

| February 2029 | ₹ 487.99 |

| March 2029 | ₹ 497.90 |

| April 2029 | ₹ 511.04 |

| May 2029 | ₹ 529.86 |

| June 2029 | ₹ 568.42 |

| July 2029 | ₹ 575.08 |

| August 2029 | ₹ 581.88 |

| September 2029 | ₹ 593.70 |

| October 2029 | ₹ 571.60 |

| November 2029 | ₹ 597.43 |

| December 2029 | ₹ 610.11 |

5Paisa Share Price Target 2030

| Month | Share Price Target |

| January 2030 | ₹ 650.43 |

| February 2030 | ₹ 658.70 |

| March 2030 | ₹ 664.97 |

| April 2030 | ₹ 671.30 |

| May 2030 | ₹ 689.54 |

| June 2030 | ₹ 692.74 |

| July 2030 | ₹ 705.11 |

| August 2030 | ₹ 724.08 |

| September 2030 | ₹ 749.42 |

| October 2030 | ₹ 757.04 |

| November 2030 | ₹ 763.60 |

| December 2030 | ₹ 780.85 |

5Paisa Share Price Target 2035

| Month | Share Price Target |

| January 2035 | ₹ 890.04 |

| February 2035 | ₹ 896.43 |

| March 2035 | ₹ 891.50 |

| April 2035 | ₹ 912.06 |

| May 2035 | ₹ 929.74 |

| June 2035 | ₹ 938.91 |

| July 2035 | ₹ 946.55 |

| August 2035 | ₹ 954.09 |

| September 2035 | ₹ 969.75 |

| October 2035 | ₹ 975.60 |

| November 2035 | ₹ 971.32 |

| December 2035 | ₹ 982.79 |

5Paisa Share Price Target 2040

| Month | Share Price Target |

| January 2040 | ₹ 1,513.89 |

| February 2040 | ₹ 1,532.05 |

| March 2040 | ₹ 1,548.31 |

| April 2040 | ₹ 1,557.80 |

| May 2040 | ₹ 1,564.35 |

| June 2040 | ₹ 1,571.60 |

| July 2040 | ₹ 1,579.41 |

| August 2040 | ₹ 1,594.70 |

| September 2040 | ₹ 1,608.40 |

| October 2040 | ₹ 1,622.75 |

| November 2040 | ₹ 1,631.80 |

| December 2040 | ₹ 1642.90 |

Stock Return Calculator

Technical Analysis

The current market in December 2025 is ₹347, which is 7.88% above from the previous close of ₹315.80, with stock trading at 110% below its 52-week high, which is ₹758.45, and its 38.2% above from its 52-week low, which is ₹235.65, 14-days RSI is neutral which is 62.75, 50-days SMA resistance level is ₹323.75 and as per 200-Days SMA ₹364.53 is its long term resistance level.

Long-term support and resistance level

As per the current market situation, and according to Classic Pivot Level, its first support is ₹293.82, and its second support level is ₹252.68.

As per top analysts, if the market bounces back from the above support levels, its first resistance level will be ₹369.52, and its second resistance level can be ₹404.88.

Bull vs Bear Case

In Bull Case and Bear Case, multiple factors affect 5Paisa stock.

Bull Case:

- Fintech Leadership: 5Paisa is one of the leading discount stockbrokers in India. It provides multiple services in one app with a top-notch trading facility at low trading fees. It also captures new retail investors with its free demat account opening facility.

- Technological Edge: 5Paisa provides a multilingual facility, margin facility, free market research on 4000+ stocks, and it’s an AI-driven app facility. These are the most trending facilities provided by 5Paisa, which attract all types of customers.

- Profitability and Valuation: The company’s Current P/E ratio is 22.59, and its PB ratio is 1.7. These ratios are lower than those of its peer companies, and the company has shown sustainable growth in past years.

- Sector Trend: In India, the participation of retail investors is increasing rapidly, and many new demat accounts have been opened in the past few years. As per the recent data, 5Paisa offers free account opening and transparent charges, and it is a subsidiary of IIFL, which makes it more reliable to attract new customers.

- Diversification: Expansion into mutual funds, insurance, and the US markets reduces reliance on equity trading fees

Bear Case:

- High Competition: Many other stockbrokers are entering the market with new enhanced features, and big players with a big customer base and sustainable profit are already planning to enter the stock market. As we know, Groww has already launched its IPO in 2025.

- Regularity Risk: SEBI’s strict norms for discount brokers can affect profitability. SEBI rapidly took action and fined Algo Trading for glitches and operational vulnerability.

- Technical Weakness: Currently, the stock is trading at below the 200-day SMA, which is an indication of a long-term downtrend. If it breaks its support level of ₹ 328, we will see more selling pressure.

Log term growth Catalysts

5paisa’s long-term growth is dependent on India’s fintech boom, financial inclusivity and diversity, and tech innovation. With a Piotroski Score of 5/9 (indicating moderate financial strength) and a focus on high-margin products, 5Paisa stock is well-positioned to capitalize on India’s $5 trillion equity market potential by 2030. Investors should track quarterly user growth and regulatory developments for optimal entry points.

Institutions hold 22.57% of shares, which shows trust in long-term prospects. Promoter holdings also remain stable at 32.77%.

Expert Opinion

Current P/E of 22.59 (vs. sector average of 32.13) indicates undervaluation. 13, 5-year revenue of 5Paisa with a CAGR of 59.08% and improving its profit margins, the company is also the 5th largest discount stock broker in India. The main competition of the company is with Zerodha and Upstox; these two discount brokers dominate the market share. As per experts, India’s digital payment market will reach 200 trillion, which will benefit the fintech industries.