As per the recent stockbroker’s data, many new investors have come into the stock market and started their investment journey. In the share market, there are many different types of investors; some hold stocks in the short term, and some hold for the long term, but all types of investors and traders have a target they want to capture.

In this article, we will learn the Jio Finance Share Price Target 2025 to 2030 to 2040 through research of experts and their analysis, which can give you a basic idea of JFS Share Price Target in the upcoming years.

About Jio Financial Services Ltd Company

JIOFIN uses in-house services for operating the Financial Services of Jio Group, like Jio Insurance Broking Limited, and Jio Payment Solution, which works with Jio Payment Bank Limited (JPBL). All these services come under Jio Financial Services Limited.

JIOFIN was first known as Reliance Strategic Investments Private Limited on 22 July 1999. Its Name changed to Reliance Strategic Investments Limited, and again, on 14 January 2002, its name changed to Jio Financial Services Limited, and the company issued its fresh certificate.

Company Overview

| Company Essentials | Values |

| Market Cap | ₹2,27,955.84 Cr |

| No. of Shares | 635.33 Cr |

| PE | 738.27 |

| PB | 9.3 |

| Face Value | ₹10 |

| Book Value | ₹38.58 |

| ROE | 1.82% |

| ROCE | 2.16% |

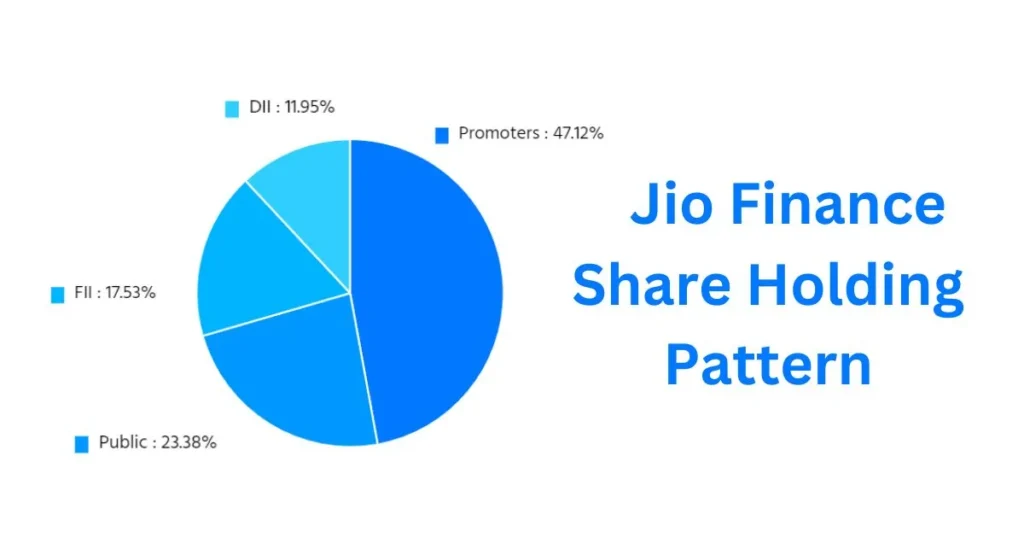

| Promoter Holdings | 47.12% |

Jio Finance Share Price Target Expert Analysis

As per expert analysis price of Jio Financial Seems to be bullish in the upcoming months its primary key factor is the Indian stock market and it is already bullish as we know Jio Finance is a subsidiary of Reliance Industry and it plays a vital role in the Indian Stock Market and Indian economy Reliance Industry it also holds largest weightage in Nifty 50 which is around 10%.

The current Price of Jio Financial Services Limited is 326.60, and its next target is 337.75. From the table below, we can see Jio Finance Share Price Target 2024, 2025, 2026, 2027, 2028, 2029, and 2030.

Jio Finance Share Price Target 2024

| Duration | Share Price Target |

| August 2024 Target for JIOFIN | ₹338.20 |

| September 2024 Target for JIOFIN | ₹352.50 |

| October 2024 Target for JIOFIN | ₹368.45 |

| November 2024 Target for JIOFIN | ₹385.85 |

| December 2024 Target for JIOFIN | ₹394.95 |

Above we can see the expected Share Price Target for Jio Financial Services Limited to watch in 2024 upcoming month.

Jio Finance Share Price Target 2025

Jio Finance Share Price Forecast 2025 Investors expect the target price of JIOFIN to be Bullish in 2025. Since Jio separated its financial services into Individuals, many FII and DII invested in its share because they saw growth in the future in this share.

The core operation of Jio Financial Services Ltd. is to provide loans to small and large businesses, manage their banking services, and offer digital services like sending and receiving payments and insurance broking. Jio Financial also provides banking services through its JIO Payments Bank.

JIOFIN Share Price Target 2025

| Month | Share Price Target |

| January 2025 Target for JIOFIN | ₹403.75 |

| February 2025 Target for JIOFIN | ₹438 |

| March 2025 Target for JIOFIN | ₹445.50 |

| April 2025 Target for JIOFIN | ₹461 |

| May 2025 Target for JIOFIN | ₹468 |

| June 2025 Target for JIOFIN | ₹474 |

| July 2025 Target for JIOFIN | ₹482 |

| August 2025 Target for JIOFIN | ₹496 |

| September 2025 Target for JIOFIN | ₹507.20 |

| October 2025 Target for JIOFIN | ₹514 |

| November 2025 Target for JIOFIN | ₹528 |

| December 2025 Target for JIOFIN | ₹532 |

Jio Finance Stock Price Target: Key Factors Future Trends

As we all know, Reliance Industries is one of the biggest antilarry in India which also has a strong future growth and plan. Jio Finance company provides future-centric services that are more demanding in the future for any business, which are listed below.

- Loan services which are always in demand

- Insurance Broking: It provides car, bike, health, and life Insurance through its Jio Insurance Broking platform.

- Payments Bank

- Payment Solution

- Leasing

Jio Finance Share Price Target 2025, 2026, 2027, 2028, 2029, 2030

| Year | Target Price |

| 2024 | ₹394 |

| 2025 | ₹532 |

| 2026 | ₹674 |

| 2027 | ₹802 |

| 2028 | ₹986 |

| 2029 | ₹1115 |

| 2030 | ₹1467 |

Peer Comparision of JIO Finance

- Bajaj Finance

- Bajaj Finserv

- Cholamandalam Investment

- Shriram Finance

- Muthoot Finance

- Aditya Birla Capital

Conclusion

In this article, we have read the complete overview of JIOFIN, as this company belongs to Reliance Industries, which is why investors see stable growth in this company. As per the news, Jio will also come to the market with its IPO in the coming month. This will give a positive signal to JIOFIN Stock. We can see upside momentum when ipo comes.

Frequently Asked Questions

What are the experts saying about Jio Finance’s share price target?

Investors are seeing upside momentum in JIOFIN because of its brand value and business plan. FII also increased its holdings since BlackRock is interested in this stock.

Jio Finance Share Price Target: Is it a Good Investment Opportunity?

For long-term investment, JIOFIN can be a good investment. We can see upside momentum in the long term and capture decent returns.

Read also:- JP Power Share Price Target 2025 To 2030, 2040, 2050 JPPOWER