Ashirwad Capital is a non-banking financial company in India. The company provides services in long-term investment. It has been doing business in the financial sector for the past 10 years, and it is one of the profit-making companies. It manages funds via investing in blue-chip companies. In this article, we learn about Ashirwad Capital Share Price Target 2025, its fundamentals, shareholding pattern, company growth factor, and its pros and cons.

What does Ashirwad Capital Do?

Ashirwad Capital provides investment and consultancy services on long-term investment through its in-house fundamental and technical analysis. The company was founded in 1985, at that time its name was Ashirwad Trading and Finance Limited, and in 1995 it changed to Ashirwad Capital Limited. In India, the Investment and consultancy industry is growing rapidly because many new investors have come into the stock market.

Fundamental Overview of Ashirwad Capital Share Price

| Company Essential | Value |

| Market Cap | ₹ 43,02 Cr. |

| Advances | ₹ 0 Cr. |

| No. Of Sares | 9 Cr. |

| P/E | 25.87 |

| P/B | 1.93 |

| Face Value | ₹ 1 |

| Book Value | ₹ 2.47 |

| Operating Revenue | ₹ 1.64 Cr. |

| Net Profit | ₹ 1.55 Cr. |

| EPS | ₹ 0.18 |

| ROE | 9.62% |

| ROCE | 10.76% |

| Sales Growth | 115 |

| Profit Growth | 103.99% |

| Dividend Yield | 0% |

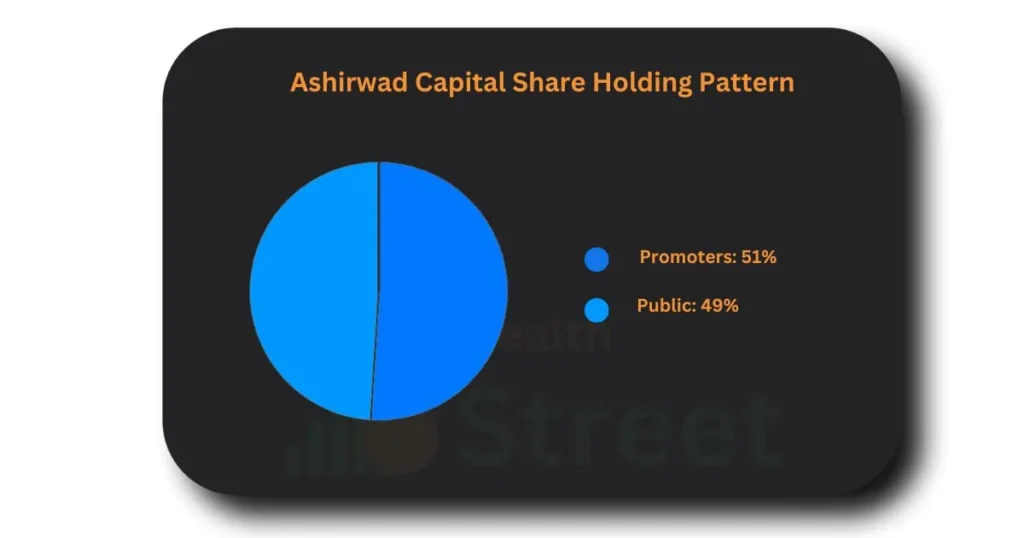

Ashirwad Capital Share Holding Pattern

The holding pattern of Ashirwad Capital is fair, as 51% of its shares are held by its promoters and 49% of its shares are in public hands. If we see FII, DII, and Mutual funds, there are no shares held by them, and company shares are also not pledged, which is good for their investors.

Growth Factors of Ashirwad Capital Share

As per Zerodha’s recent data number of investors has increased in the past few years, many people don’t want to keep money in their bank account they want to invest their money that’s why the market is making high and higher due to the increasing number of investors many new stock brokers came in the market and investors also need fund managers who manage their funds.

Ashirwad Capital manages the funds of investors and provides them with maximum return with a view to well-timed entry and exit with its in-house strong fundamental analysis and technical analysis.

Ashirwad Capital Share Price Target 2025 TO 2030

In the upcoming year, the number of individual investors will increase. Investors who have large amounts for investing take consultancy services or invest through companies like Ashirwad Capital, which will provide a boost to this industry. The range of Ashirwad Capital Share Price Target 2025 TO 2030 can be ₹6.31 to ₹ 34.71.

| Year | Share Price Target |

| 2024 | ₹ 5.51 |

| 2025 | ₹ 8.31 |

| 2026 | ₹ 11.04 |

| 2027 | ₹ 18.46 |

| 2028 | ₹ 25.51 |

| 2029 | ₹ 29.18 |

| 2030 | ₹ 34.71 |

Ashirwad Capital Share Price Target 2025

The company has a plan to focus on its growth in profitability and increase its customer base, and then it will generate more revenue. Its long-term and blue-chip investment strategy makes it a low-risk and maximum return on its investment because of its well-timed entry and exit. The expected range of Ashirwad Capital Share Price Target 2025 can be ₹5.60 to ₹8.31.

| Duration | Share Price Target |

| January 2025 | ₹ 5.60 |

| February 2025 | ₹ 5.72 |

| March 2025 | ₹ 5.85 |

| April 2025 | ₹ 6.00 |

| May 2025 | ₹ 6.31 |

| June 2025 | ₹ 6.25 |

| July 2025 | ₹ 6.45 |

| August 2025 | ₹ 6.87 |

| September 2025 | ₹ 7.30 |

| October 2025 | ₹ 7.79 |

| November 2025 | ₹ 7.94 |

| December 2025 | ₹ 8.31 |

Ashirwad Capital Share Price Target 2030

Due to the increasing number of new participants in the market, volatility will increase. The company gains a large customer base in the market, and it will also diversify its business into multiple sectors. And investors who do not have good knowledge of the fundamentals and Technicals, they start investing through companies like Ashirwad Capital Limited. The expected range of Ashirwad Capital Share Price Target 2030 can be ₹29.50 to ₹34.31.

| Duration | Share Price Target |

| January 2030 | ₹ 29.50 |

| February 2030 | ₹ 29.73 |

| March 2030 | ₹ 29.93 |

| April 2030 | ₹ 30.10 |

| May 2030 | ₹ 30.26 |

| June 2030 | ₹ 30.48 |

| July 2030 | ₹ 31.05 |

| August 2030 | ₹ 31.56 |

| September 2030 | ₹ 32.00 |

| October 2030 | ₹ 32.71 |

| November 2030 | ₹ 33.12 |

| December 2030 | ₹ 34.31 |

Expert Opinion For Ashirwad Capital Share Price Target 2025 TO 2030

As per the technical and fundamental analysis, in the long term, Ashirwad Capital Limited can provide good returns to its investors. Because the company’s low-risk strategy attracts more customers, which increases its market cap and profitability, which will attract new investors, and we can see growth in its share.

ALso Read

REFEX Industries Share Price Target

Pros

- Good ROA of 7.90% in the last 3 years.

- Ashirwad Capital is trading at 1.62 times its book value

- 3 years CAGR 38.40%.

- Profit growth of 39.08% over the past 3 years.

- Promoter shareholdings are 51%.

Cons

- PAT margin decreased to 5.09%.

- Provisions and contingencies increased 58.13%.

Conclusion

In this article, we have learned about Ashirwad Capital Share Price Target 2025 and its fundamentals. In the past 3 years, company profit growth has increased. Company fundamentals are fair. Due to the company’s strong business plan, it makes it profitable.