Texmaco Rail Share Price Target 2025: It is a leading freight car manufacturer in India. The company also provides manufacturing services to railways, like rolling stock, rail tunnels, traction & coaching, bridges, structural, and processed equipment for railways. In this article, we will get complete knowledge of the Texmaco Rail Share Price Target 2025 to 2030. If we see company investment returns in the past four years, it has given 788.45% returns on equity shares to its investors. In this article, we will also get the company’s financial performance, growth factors, and shareholding patterns.

What Does Texmaco Rail Do?

Texmaco Rail & Engineering Ltd. is a private engineering and infrastructure company in India. It has primary business in the manufacturing of railway wagons, coaches, and locomotives, and its secondary business is steel foundry, rail EPC, bridges, and structural and process equipment. The company was established in 1939, and it has a strong presence in the market. It also has collaborations and partnerships with many companies, such as Wabtec Corporation and Nymburk.

Fundamental Overview of Texmaco Rail (TEXRAIL)

| Company Essentials | Value |

| Company Name | Texmaco Rail & Engineering Ltd. |

| NSE Code | TEXRAIL |

| BSE Code | 533326 |

| Market Cap | ₹ 8,013.31 Cr. |

| Enterprise Value | ₹ 8,235.60 Cr. |

| P/E | 57.91 |

| Book Value | ₹ 63.23 |

| Face Value | ₹ 1 |

| Debt | ₹ 629.72 Cr. |

| ROE | 5.88 % |

| Sales Growth | 56.15% |

| Profit Growth | 468.09 % |

| Dividend Yield | 0.25 % |

| Officials Website | TEXRAIL |

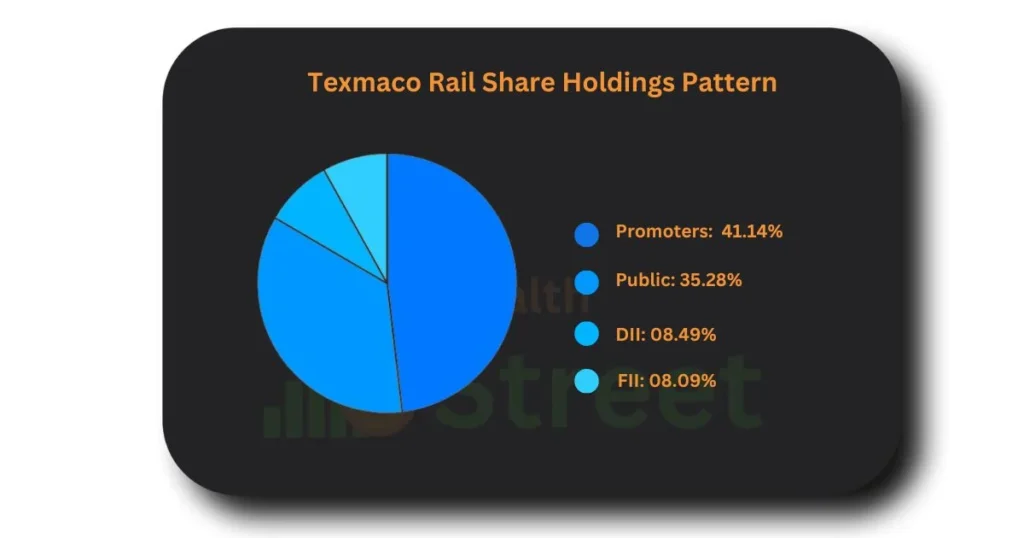

Texmaco Rail Share Holding Pattern

If we see the holding pattern of Texmaco Rail company, which has only 35.28% of its shares in public, which is good for the stability of the company, this year compared to the previous year, promoters have decreased their holding by 2%, but DII and FII have constitutionally increased their holdings.

| Promoters | 41.14% |

| Public | 35.28% |

| DII | 08.49% |

| FII | 08.09% |

Texmaco Rail Share Price Target 2025 – 2050

| Year | Share Price Target |

| 2025 | 125 to 291.90 |

| 2026 | 300 to 413 |

| 2027 | 418 to 524 |

| 2028 | 530 to 651 |

| 2029 | 655 to 784 |

| 2030 | 780 to 510 |

| 2035 | 836 to 922 |

| 2040 | 1360 to 1504 |

| 2050 | 2260 to 2830 |

Key Factors Influencing Texmaco Rail Share Price Target 2025

Texmaco Rail & Engineering Ltd. has plans to expand and strengthen its business in various sectors like engineering, procurement, and construction in the upcoming five years.

Here are a few points that indicate the company’s future growth in the upcoming years.

Doubling Business: The company aims to double its strength and market presence recently (December 2024). The company got multiple orders from Chhattisgarh State Power Transmission for the construction of a transmission line.

Market Expansion: TEXRAIL is expanding its business in India as well as in the International markets of Liberia, Mozambique, Cameroon, Bangladesh, Sri Lanka, Ghana, Senegal, Mali, Zambian Railways, Vietnam, Uganda, Hungary, Yugoslavia, etc., where they export train wagons.

Rail Infrastructure Upgradation: Texmaco Rail plays a vital role in upgrading India’s rail infrastructure. The company is known for its manufacturing of different kinds of quality wagons. The Indian railway company provides its services for Track work, Railway Signaling, Telecommunication in Indian railway for safety block, Railway Electrification, Power Distribution, OHE Electrification, and allied works.

Healthy Order Book: The company has a healthy order book because of the growing demand for various types of wagons in India and other countries. In the construction sector, the company gets multiple projects from several states for the construction of transmission lines, bridges, and also supplies hydro-mechanical equipment for generating electricity.

Texmaco Rail Share Price Target 2025

| Duration | Share Price Target |

| April | ₹ 173 |

| May | ₹ 201 |

| June | ₹ 216 |

| July | ₹ 236 |

| August | ₹ 259 |

| September | ₹ 275 |

| October | ₹ 282 |

| November | ₹ 278 |

| December | ₹ 291.90 |

Texmaco Rail Share Price Target 2030

| Duration | Share Price Target |

| January 2025 | ₹ 780 |

| February 2025 | ₹ 650 |

| March 2025 | ₹ 584 |

| April 2025 | ₹ 638 |

| May 2025 | ₹ 695 |

| June 2025 | ₹ 642 |

| July 2025 | ₹ 597 |

| August 2025 | ₹ 549 |

| September 2025 | ₹ 602 |

| October 2025 | ₹ 572 |

| November 2025 | ₹ 536 |

| December 2025 | ₹ 510 |

Texmaco Rail Share Price Target 2035

| Duration | Share Price Target |

| January 2035 | ₹ 836 |

| February 2035 | ₹ 813 |

| March 2035 | ₹ 795 |

| April 2035 | ₹ 772 |

| May 2035 | ₹ 785 |

| June 2035 | ₹ 798 |

| July 2035 | ₹ 835 |

| August 2035 | ₹ 851 |

| September 2035 | ₹ 877 |

| October 2035 | ₹ 894 |

| November 2035 | ₹ 903 |

| December 2035 | ₹ 922 |

Texmaco Rail Share Price Target 2040

| Duration | Share Price Target |

| January 2040 | ₹ 1360 |

| February 2040 | ₹ 1379 |

| March 2040 | ₹ 1394 |

| April 2040 | ₹ 1419 |

| May 2040 | ₹ 1452 |

| June 2040 | ₹ 1438 |

| July 2040 | ₹ 1461 |

| August 2040 | ₹ 1485 |

| September 2040 | ₹ 1473 |

| October 2040 | ₹ 1488 |

| November 2040 | ₹ 1495 |

| December 2040 | ₹ 1504 |

Texmaco Rail Share Price Target 2050

| Duration | Share Price Target |

| January 2050 | ₹ 2260 |

| February 2050 | ₹ 2289 |

| March 2050 | ₹ 2363 |

| April 2050 | ₹ 2391 |

| May 2050 | ₹ 2435 |

| June 2050 | ₹ 2510 |

| July 2050 | ₹ 2590 |

| August 2050 | ₹ 2673 |

| September 2050 | ₹ 2691 |

| October 2050 | ₹ 2740 |

| November 2050 | ₹ 2795 |

| December 2050 | ₹ 2830 |

Expert Opinions & Institutional Activity For TEXRAIL 2025 To 2050

In India, the railway infrastructure is increasing rapidly. In the budget 2025, we can see huge growth in railway stocks, and the government is focusing on robust Railway infrastructure and making it a profitable sector. Indian Railways is also one of the cheapest modes of transportation in the country, and it is also the second busiest transportation system in the world. Railways help business to reduce their supply chain cost in their initial stage.

As per experts, Texmaco Rail is considered a multi-bagger stock in the upcoming year because of its strategic business model in multiple sectors. The company always maintains its quality and has positive trust among its customers, which is the most important thing in business to grow in the long term.

Also, Check

Bull vs. Bear Case for 2025

Bull Case

- The Indian government continuously pushes for the development of railway infrastructure. This can increase the demand for Texmaco products like wagons, coaches, and other Rail components.

- Budget allocation in the Railway in the Union Budget will also impact Texmaco’s share price growth.

- Privatization of Indian Railway and Public-Private Partnerships is beneficial for Texmaco Rail to get more contracts and expand its market share.

- Due to India’s growing economy, the demand for freight transportation and logistics will also increase. Texmaco is the leading manufacturer of wagons, which will benefit the company in getting more orders for freight wagons.

Bear Case

- The slowdown of government spending on railway projects can hurt Texmaco Rail because it can slow down revenue growth.

- Competition and Pricing pressure from the domestic and international markets can decrease the profit margin of the company.

- Changing government policies, environmental regulations, and other compliance requirements can increase operational costs and delay projects, which will negatively impact the company.

- Delays in projects, economic slowdown, and dependence on Indian railways will affect company growth in the long term.

Pros

- The company has diversified its business in multiple sectors, which is good for the growth of the company in the long term.

- The company has an experienced management and technical team that provides high-standard and efficient operations.

- Texmaco Rail has a house manufacturing facility of steel foundries, a heavy engineering workshop, and other critical components.

- Most of the Indian railway contracts and other government entities are secured by Texmaco Rail, which delivers huge revenue to the company.

- The company continuously invests in its research and development to improve its quality to global standards.

Cons

- The railway and heavy engineering sector is cyclical; during economic downturns, its demand and profitability are also affected.

- Due to dependency on Government orders, the company’s significant revenue came from government contracts. Changes in government policy can delay project approvals.

- The company relies on a complex supply chain for raw materials and components, making it vulnerable to disruptions and price volatility.

Conclusion

Texmaco Rail is one of the leading manufacturers of Rail wagons in India. The company has diversified its business in various sectors, and it is also a profit-making company in its sector. In this article, we have read a complete overview of Texmaco Rail Share Price Target 2025 to 20230, its shareholding pattern, and company growth factors.