NHPC Share Price Target 2025: If we see green energy stocks we have found in the past few months green energy stocks are on an uptrend because of government policy, the Indian government has to focus on sustainable green energy sources and make India carbon neutral, and NHPC have business in green energy and this new policy and market demand make a huge impact of NHPC Share Price Target 2025, in this article, we will get complete details about company fundamental, its growth factor, shareholding patterns and expert opinions.

About NHPC Ltd.

The full name of NHPC is National Hydroelectric Power Corporation, and it is India’s leading public sector hydropower company. And it was founded in 1975. NHPC has made it to the list of Navratna Companies of India. The company’s primary business is developing hydroelectric power; recently, it has expanded its business into various green energy sectors like solar, geothermal, tidal, and wind. NHPC’s current capacity of power generation is 7096 MW through all 24 plants, and its six 4425 MW Hydro Power Projects are under construction. The Government of India is the largest shareholder of the company with a 67.40% stake.

Fundamental Analysis of NHPC Ltd. Share Price Target 2025

NHPC is a trending large-cap stock on NSE and BSE, and it is present in 34 Indices, with a PE of 23.61, and sector PE is 33.55. Its 52-week low is ₹48.40 and its 52-week high is ₹118.40. Currently, the company’s profit growth is negative, which is -2.34%, and its sales growth is -9.78%. The debt-to-equity ratio of the company is 0.79, and its price-to-flow is 14.81. The interest coverage ratio is 6.92. At this time, the valuation of NHPC is high, but the company has shown good signs of profitability and efficiency.

NHPC Ltd. Financial Performance

| Company Essentials | Value |

| Company Name | National Hydroelectric Power Corporation |

| NSE Script | NHPC |

| BSE Script | 533098 |

| Market Cap | ₹ 84,549.06 Cr. |

| Enterprise Value | ₹ 1,12,947.54 Cr. |

| P/E | 23.61 |

| Book Value | ₹ 38.06 |

| Face Value | ₹ 10 |

| Debt | ₹ 29,390.99 Cr. |

| ROE | 10.30 % |

| Sales Growth | -9.78% |

| Profit Growth | -2.34 % |

| Dividend Yield | 2.26 % |

| Officials Website | NHPC Ltd. |

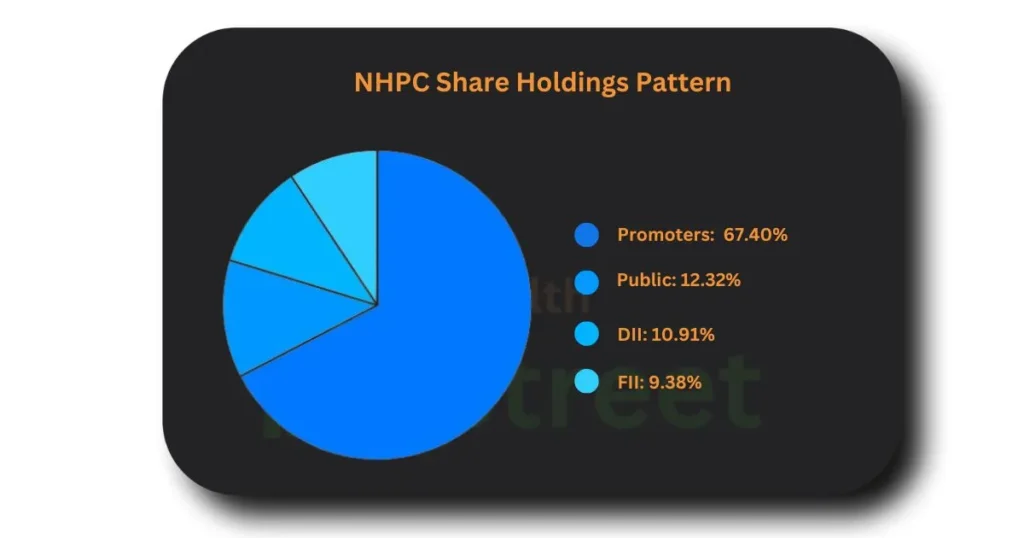

NHPC Ltd. Share Holding Pattern 2025

Share holdings of NHPC are very strong; 67.40% of shares are held by its Promoters (President of India), and 12.32% of its shares are held by the public (individual investors). 10.91% of its shares are held by DII, and 9.38% shares are held by FII. A large number of shares are held by its promoter, which makes its share stable; large public holdings suffer from unfair activities. If we see the holding summary of NHPC, we will see that FII (Foreign Institutional Investors) are increasing their holdings, which is a good sign.

Growth Factor of NHPC Ltd. Share Price Target 2025

The future growth of any company is important for sustaining in the market in the long term. Here are the top factors that impact the Share Price Target of NHPC in 2025. Due to the production of green energy, companies have a higher probability of growth in the future.

Renewable Energy (Green Energy): NHPC has its business in the production of electricity through hydropower, solar power, tidal energy, and wind energy, which are fully renewable sources of energy without producing carbon dioxide, and they can be produced at low cost and low maintenance, which will increase the company’s revenue in the long term.

Diversification: The Company’s main business was electricity generation through hydropower, but recently the company expanded its business into various green energy sources like solar, tidal, and wind energy. These are the most demanding in the future because of the decreasing fossil fuels. Because of this diversification in business, the company attracts many new investors through the market. If we see its previous chart, we can see upside momentum in this stock.

Strategic Partnership: NHPC has joint partnerships with various ventures to develop hydropower projects in multiple states in India, such as Jammu and Kashmir, Sikkim, Madhya Pradesh, and Uttar Pradesh.

Financial Performance: In the past year, the company has given a decent return to its investors, and it has strong holdings of promoters, which is 67.40%. In FY24, the company reported its sales of ₹9,632 crores and a net profit of ₹4,928 crores.

NHPC Share Price Past Data (Technical)

In the past 5 years, the company has given a return of 255.19% to its investors, which is a good return, but if we look at a short-term return, the company’s performance is negative; however, in the long term, it has been good. Currently, technical indicators are showing strong selling in NHPC Ltd., and its support level is ₹73.52, and its resistance is ₹91.49.

Here we can see NHPC Short term and long-term return.

| Short Term Return | Long Term Return | ||

| 1 Week | -9.89% | 1 Year | 62.48% |

| 1 Month | -12.94% | 2 Years | 97.71% |

| 3 Months | -23.53% | 3 Years | 163.83% |

| 6 Months | -7.34% | 4 Years | 307.20% |

| 9 Months | 8.03% | 5 Years | 255.19% |

NHPC Share Price Target 2025, 2030, 2040 and 2050

Here we can see an expected range of NHPC Share Price Target 2025 to 2050 as per company technical and fundamental analysis.

| Year | Share Price Target |

| 2025 | ₹118.54 |

| 2026 | ₹ 187.20 |

| 2027 | ₹ 104.32 |

| 2028 | ₹ 197.50 |

| 2029 | ₹ 285.62 |

| 2030 | ₹ 334.80 |

| 2040 | ₹ 863.19 |

NHPC Share Target Price Range 2025

Range calculation of any share before investing is very necessary because it gives us an idea about exit, where we can book profit, as per fundamental company valuation, which is currently high, but its ownership is stable, and its financials are average. Due to the higher demand, renewable energy companies are getting more orders from various states. The expected price range of NHPC shares in 2025 can be ₹95.73 to ₹118.54.

NHPC Share Price Target 2025 (Monthly)

| Month | Share Price Target |

| January | ₹ 95.73 |

| February | ₹ 98.30 |

| March | ₹ 103.53. |

| April | ₹ 109.34 |

| May | ₹ 113.08 |

| June | ₹ 105.28 |

| July | ₹ 107.02 |

| August | ₹ 111.63 |

| September | ₹ 115.30 |

| October | ₹ 109.28 |

| November | ₹ 113.95 |

| December | ₹ 118.54 |

NHPC Share Target Price Range 2030

The company is expanding its business into other renewable energy projects like wind energy, geothermal energy, and tidal energy. By 2030, the government has planned to make renewable energy a primary source of electricity in India, and it will be more demanding, which is very good for the company in the long-term growth. It will also attract foreign and domestic investors. The expected target range of NHPC

NHPC Share Price Target 2030 (Monthly)

| Month | Share Price Target |

| January | ₹ 290.53 |

| February | ₹ 294.87 |

| March | ₹ 300 |

| April | ₹ 312.25 |

| May | ₹ 316.05 |

| June | ₹ 320.86 |

| July | ₹ 323.91 |

| August | ₹ 328.50 |

| September | ₹ 331.04 |

| October | ₹ 327.02 |

| November | ₹ 330.75 |

| December | ₹ 334.80 |

NHPC Share Price Target 2040 (Monthly)

Till 2040, NHPC Ltd. will touch a new high because of its strong growth. Here we see the NHPC Share Target Price Range for the 2040 month-wise.

| Month | Share Price Target |

| January | ₹ 635.04 |

| February | ₹ 654.82 |

| March | ₹ 668.02 |

| April | ₹ 685.30 |

| May | ₹ 724.08 |

| June | ₹ 752.20 |

| July | ₹ 778.96 |

| August | ₹ 791.44 |

| September | ₹ 804.53 |

| October | ₹ 827 |

| November | ₹ 844.50 |

| December | ₹ 863.19 |

Also Read

Peer’s of NHPC Ltd.

- SJVN

- Adani Power

- Waaree Renewables

- Neyveli Lignite

- TATA Power

- Adani Energy Solution

- JSW Energy

- Torrent Power

Conclusion

In this article, we have read brief details about the NHPC Share Price Target 2025 to 2050. As per the current market situation, analysts have given a see rating to the stock. For a few months, we’ve been seeing a downtrend in this stock. Currently, this stock is trading at its highest valuation, which is ₹84.17, and its promoter holding is 67.4%.

Disclaimer:- This article is made for educational purposes only. So before making an investment decision, we are requesting that you contact a registered advisor.