Almost all parents dream of securing a bright future for their child, and they want them to pursue a world-class education and higher studies abroad, or top colleges/universities in India, as well as achieve financial Independence. As a parent, to achieve these goals, a combination of protection and disciplined investment plays a very important role. To fix this, SBI Life launched its SBI Life Smart Scholar Plus plan. This plan is a Unit Linked Insurance Plan (ULIP), which is specially for children. An interesting thing about this is insurance protection with a market-linked wealth creation plan.

As we know, ULIPs don’t offer guaranteed returns. Many parents often wonder: “How much will I really get at maturity?” The answer lies in using an SBI Smart Scholar Returns Calculator.

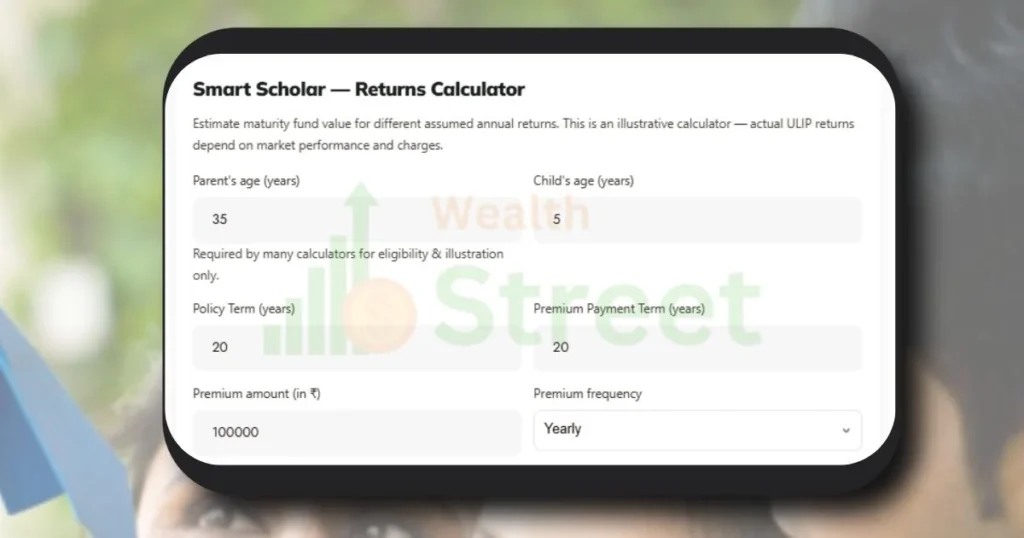

Smart Scholar — Returns Calculator

Estimate maturity fund value for different assumed annual returns. This is an illustrative calculator — actual ULIP returns depend on market performance and charges.

Also Check:

Our calculator helps you estimate the following:

- Maturity Value of Fund in Future.

- Death benefit payable to the child in case the insured parent passes away

- Impact of Fees and Loyalty Additions on Returns.

- Provide multiple scenarios based on conservative, moderate, and aggressive return assumptions

In this article, we will learn everything about the SBI Smart Scholar Plus plan and returns calculator, complete with scenarios, tips, and FAQs.

What is the SBI Smart Scholar Plus Plan?

SBI Smart Scholar Plus is a child ULIP plan by SBI Life Insurance that provides:

- Market-linked wealth creation: Deposited premiums are invested in different fund options.

- Life insurance cover: In case the policyholder (parent) dies during the policy term, a lump sum amount is paid immediately, plus all future premiums are waived.

- Child’s security: The policy will continue till maturity, ensuring that the child receives the fund value.

- Flexibility: In this plan, customers get the benefits of choosing their investment between equity, balanced, or debt funds. They can also switch between funds based on market conditions.

- Add-ons: Policyholders get stronger protection in this plan, like Accident Benefit and Waiver of Premium.

Like other traditional child plans in the market, Smart Scholar Plus gives you the benefit of equity growth potential while ensuring your child’s future is safeguarded.

Why Do You Need a Returns Calculator for Smart Scholar Plus?

Unlike FD or PPF, where returns are predictable, but in Smart Scholar Plus, returns depend on numerous factors:

- Premium mode (single, regular, or limited)

- Premium allocation and charges

- Fund choice (equity vs debt vs balanced)

- Fund management charges (FMC)

- Market performance

- Loyalty additions

- Policy term and payment term

The SBI Smart Scholar Calculator simulates these variables, helping you answer important questions like:

- What much my maturity value if I invest ₹1 lakh/Year for 10 years?

- How much difference when? If I choose an equity fund over a balanced fund?

- How do charges and loyalty additions impact my returns?

- What is the effective CAGR (Compound Annual Growth Rate) of this plan?

- What will my child get if something happens to me mid-term of the plan?

Key Features of SBI Smart Scholar Plus Plan

- Dual Protection – Insurance + investment.

- Premium Options – Single pay, regular pay, or limited pay.

- Policy Term – 8 to 25 years. At maturity child’s age must be 18 years.

- Entry Age – Parent (Minimum 18 and Maximum 50 years), Child (0–17 years).

- Fund Options – 10 different fund choices that range from pure equity to debt.

- Loyalty Additions – Extra units will be allocated in later years.

- Partial Withdrawals – Allowed only minimum of 5 years of policy.

- Death Benefit – Higher of Assured Amount or 105% of premiums paid, and waiver of remaining premiums.

- Tax Benefits – Plan holders are eligible to get benefits under current income tax laws (Section 80C & 10(10D), subject to changes).

Charges in Smart Scholar Plus That Affect Returns

Before using the SBI Life Smart Scholar Plan Calculator, we need to understand the charges of this plan. It is easy to understand the given result.

- Premium Allocation Charges: Advance deduction before investment. Higher in the starting years.

- Fund Management Charge (FMC): Deduction of ~1.25–1.35% annually, depending on fund type.

- Policy Administration Charges: Monthly charge depending on the chosen premium mode.

- Switching Charges: The Company offers free limited switches; after that, they charge a nominal fee.

- Discontinuance Charges: In case the policyholder wants to cancel the policy early.

- Mortality & Rider Charges: This deduction is based on insurance cover and rider selection.

These are some charges in the SBI Smart Scholar Plus Plan that reduce the effective return; that’s why calculators are necessary.

How the SBI Smart Scholar Plus Returns Calculator Works

Smart Scholar Plus returns calculator uses the following formula:

- Investment = Premium Paid – Charges

- Net Units = Investment ÷ Fund NAV

- Fund Value Growth = Net Units × NAV Growth (based on expected return assumption)

- Loyalty Additions = Extra units added at certain policy years

- Maturity Value = Total Fund Value at the end of the term

For death benefit:

- Immediate payout = Higher of Sum Assured or 105% of premiums paid

- Also provides benefits like a waiver of premium that continues till maturity

- The child will get the fund value on maturity

Inputs Needed in the Calculator

To use the SBI Smart Scholar Returns Calculator, you’ll need:

- Parent Age

- Premium amount

- Premium payment mode (single, regular, limited)

- Policy term

- Child’s age at entry

- Fund option (equity/balanced/debt)

- Expected return (%)

- Withdrawal assumptions (if any)

Sample Calculations with SBI Smart Scholar Returns Calculator

Scenario 1: Regular Pay (20 years), Balanced Fund

- Parents’ age: 35

- Child’s age: 5

- Policy Term: 20 years

- Premium: ₹1,00,000 yearly

- Fund: Balanced

- Expected return: 6% (conservative), 8% (moderate), 10% (aggressive)

Results:

| Total Premium Paid = | ₹20,00,000 |

| Conservative (6%) = | ₹22.5–24 lakh |

| Moderate (8%) = | ₹30–32.5 lakh |

| Aggressive (10%) = | ₹38–41 lakh |

Scenario 2: Single Pay, Equity Fund

- Parents’ age: 40

- Child’s age: 10

- Term: 10 years

- Premium: ₹5,00,000 lump sum

- Fund: Equity

- Returns assumed: 8%, 10%, 12%

Results:

On a single payment of ₹5,00,000 for 10 years.

| Return Percentage | Return Amount |

| 8% | ₹10–11 lakh |

| 10% | ₹12.5–13.5 lakh |

| 12% | ₹15–16.5 lakh |

Scenario 3: Limited Pay (10 years), Equity-Debt Mix

- Parents’ age: 32

- Child’s age: 7

- Policy Term: 18 years

- Premium: ₹1,20,000 yearly (for 10 years)

- Fund Split: 70% Equity, 30% Debt

- Returns assumed: 7%, 9%, 11%

Results:

| Total Paid | ₹12,00,000 |

| 7% | ₹15.5–16.5 lakh |

| 9% | ₹20.5–22.5 lakh |

| 11% | ₹27–29.5 lakh |

Tips to Maximize Returns from Smart Scholar Plus

- Start sooner if possible for longer compounding.

- If you want to invest in long-term, choose equity funds, and debt for short-term safety.

- Yearly premium pay can reduce frequency charges.

- Avoid early withdrawals.

- Stay invested for the full term (try not to don’t discontinue early).

- Monitor fund performance time to time and switch if needed (if you get a better return in another option).

- Recalculate returns annually with updated assumptions.

How to Interpret Calculator Results

- Maturity Value = Estimated amount at term end

- Total Premiums Paid = Your cost of investment

- Effective CAGR = Growth rate after charges

- Death Benefit = Lump sum (Sum Assured or 105% of premiums) + waiver of premium

- Fund Risk = Equity = high return/high risk, Debt = safe/low return, Balanced = middle path

Alternatives to SBI Smart Scholar Plus

- HDFC Life YoungStar ULIP

- ICICI Pru SmartKid

- LIC Traditional child plans (endowment/money back)

- Mutual funds + term insurance combo

But Smart Scholar Plus stands out due to loyalty additions and the PPWB benefit.

FAQs

Q1: What is the SBI Smart Scholar Returns Calculator?

It is an online free tool that estimates maturity values and benefits of SBI Smart Scholar Plus based on user inputs like premium, term, and expected return.

Q2: Are returns guaranteed?

No. Returns are guaranteed. This plan is market-linked and depends on fund performance.

Q3: Can I withdraw before maturity?

Partial withdrawals are allowed after 5 years, subject to limits.

Q4: What if the parent dies during the policy?

Child gets death benefit + waiver of premium. Policy continues, and the fund value is paid at maturity.

Q5: Are there tax benefits?

Yes, under Section 80C and 10(10D), subject to prevailing tax laws.

Conclusion

SBI Smart Scholar Plus is one of the most elaborate child ULIP plans in India, a combination of life protection with market-linked wealth creation. You can read full policy details in the Smart Scholar Plus PDF. However, due to its complex charges and fund options, understanding the real maturity value is not easy.

That’s why the SBI Smart Scholar Returns Calculator plays an important role. By calculating premiums, fund choices, and return assumptions, you can estimate realistic outcomes and make better decisions.

Whether you’re a small investor choosing debt funds or an aggressive parent opting for equities, always compare the above scenarios and factor in charges. Make a plan early, stay invested, whether your child’s dream is higher education or a global career, it can be achieved.