Financial planning is not just a choice; it’s a necessity for a better future. Due to our rising expenses, maintaining a lifestyle, and the need for long-term wealth creation, it is crucial to select the right investment cum-insurance plan. SBI Life Insurance, one of India’s most trusted names, offers the SBI Wealth Builder Plan. This plan provides both protection and savings in a single policy.

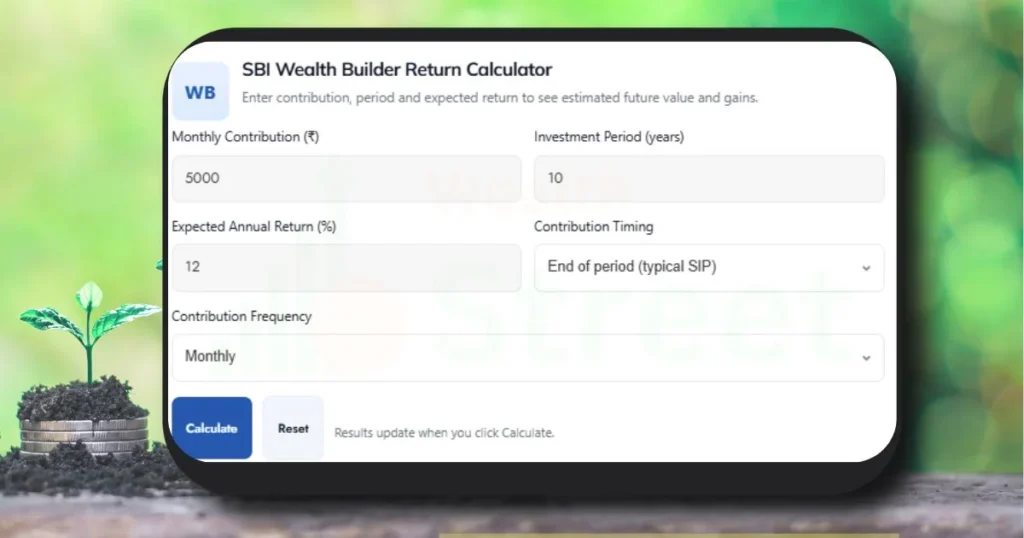

To make the investment journey easier, we have built this Free SBI Wealth Builder Return Calculator. This online tool is simple and easy to use; with the help of this calculator, users can estimate their maturity value, bonuses, and potential wealth growth before investing.

Try the calculator below and check your returns instantly without entering your personal data:

SBI Wealth Builder Return Calculator

Enter contribution, period and expected return to see estimated future value and gains.

This free tool provides a quick overview of expected returns at policy maturity, helping you make informed financial decisions.

Also Check:

What is the SBI Wealth Builder Plan?

The SBI Wealth Builder Plan is a non-linked, non-participating single (individual) life insurance savings plan. This policy comes with the following benefits:

- Financial protection: The Rider gets life cover benefits during the policy term.

- Guaranteed returns: Lump sum maturity benefits after the policy tenure.

- Wealth creation: Tax benefits while securing long-term savings.

- Flexibility: Policyholders have the option to choose premium payment terms and policy durations.

In simple terms, this is a dual-benefit plan—ensuring your loved ones are protected while simultaneously building a guaranteed financial fund.

By many investors, this plan is also called the SBI Wealth Builder Policy or SBI Wealth Builder Investment Plan.

SBI Wealth Builder Return Calculator – How It Works

The SBI Wealth Builder Return Calculator is specially designed to provide an instant estimate of your returns without login or registration. Instead of manually going through brochures, charts, and assumptions, you only need to enter your basic details, and this free tool calculates your maturity value instantly.

Here’s how it works:

- Required Input Fields: Premium amount (monthly, quarterly, yearly)

- Policy term (in years)

- Premium payment term

- Age of the policyholder

- Sum assured (if available)

- Calculation Logic: This calculator takes into account the guaranteed insurance amount, bonuses, and survival benefits.

- It provides you with an estimated maturity benefit, which you may receive at the end of the policy term.

- If applicable, it will also provide an overview of death benefits (life cover).

- Result Output: Get total estimated maturity value

- Guaranteed additions (if any)

- Death benefit

SBI Wealth Builder Return Calculator

Enter contribution, period and expected return to see estimated future value and gains.

Key Features of SBI Wealth Builder Return Calculator

This calculator is built for all kinds of users with simplicity and accuracy in mind. Here are some main features:

- User-Friendly: With a Clean interface and minimalist input fields.

- Instant Results: Provide return estimates in just one click.

- Zero Cost: Free to use, no need to sign up or log in.

Example: SBI Wealth Builder Return Calculation

Let’s take an example to understand how the calculator works.

- Age of policyholder: 35 years

- Paid premium amount: ₹50,000 per year

- Policy term: 15 years

- Premium payment term: 15 years

Estimated Output:

| Details | Value |

|---|---|

| Total Premium Paid | ₹7,50,000 |

| Guaranteed Additions | ₹2,00,000 |

| Maturity Benefit | ₹9,50,000 |

| Life Cover (Death Benefit) | ₹10,00,000 |

Why Use SBI Wealth Builder Calculator Before Investing?

Before investing your hard-earned money, it’s better to know what kind of return you can expect from that investment. That’s why using a calculator is essential.

- Transparency: No charges or confidential detail requirement, it’s 100% safe.

- Financial Planning: Provide you with an overview and help you to decide on premium affordability and policy term.

- Comparison: You can compare different scenarios, such as ₹50,000 vs ₹1,00,000 premium.

- Time-Saving: No need to manually check policy brochures.

- Decision Support: Helps in choosing the right investment strategy.

FAQs on SBI Wealth Builder Return Calculator

How accurate is the SBI Wealth Builder calculator?

This calculator provides estimated returns which is based on the standard assumptions and your inputs. Actual maturity values may vary depending on policy terms, bonuses, and underwriting conditions.

Can I calculate the maturity value instantly?

Yes! Just enter the required inputs. The calculator gives you results in a second.

Is this calculator free to use?

Absolutely. It’s a free online tool designed for all kinds of users.

Does it include tax benefits?

Yes, the calculator also considers tax savings under Section 80C and 10(10D), though actual benefits depend on your taxable income.

Can I use this calculator for other SBI Life policies?

This tool is specifically designed for the SBI Wealth Builder Plan, but we also provide some other calculators, like SBI Smart Scholar, SIP, and other investment plans.

Conclusion

The SBI Wealth Builder Return Calculator can be a very necessary tool for anyone who is considering this policy. It eliminates assumptions, saves time, and provides detailed information on your financial journey. By using the calculator, you can estimate your maturity value, understand guaranteed benefits, and plan your investments confidently.