Ashapuri Gold Ornament Ltd. is one of India’s leading wholesale manufacturers and suppliers of gold jewellery. In the past few years, demand for gold jewellery has increased in India. People are more interested in buying gold ornaments, and we can see this effect in gold company stock prices and also in the prices of gold jewellery in the market.

In this article, we will discuss Ashapuri Gold Share Price Target 2025 to 2030, as well as discuss the shareholding pattern of the company, its market overview, and Technical and Fundamental Analysis as per experts. As we know, India is a prominent market for jewellery, which is good for ornament manufacturing companies.

About Ashapuri Gold Ornament Ltd.

Ashapuri Gold Ornament Ltd. was established in 1997. The company was known for its quality products, which they promised, and most of its stores were found in metro cities. The company serves its product in eleven states in India. Ashapuri Gold has not diversified its business; it has its business in only gold jewellery manufacturing. Because of its quality, the company has a good customer base in the market.

Market Overview Of Ashapuri Gold Share Price Target 2025

| Market Essentials | Values |

| Market Cap | ₹ 242.32 Cr |

| Enterprise Value | ₹ 244.08 Cr |

| No. Of Shares | 33.33 Cr |

| P/E | 25.14 |

| P/B | 1.71 |

| Face Value | ₹ 1 |

| Book Value | ₹ 4.24 |

| Debt | ₹ 1.82 Cr |

| EPS | ₹ 0.29 |

| ROE | 8.61% |

| ROCE | 11.57% |

| Profit Growth | 315.69% |

| Sales Growth | 4.47% |

| Dividend Yield | 0% |

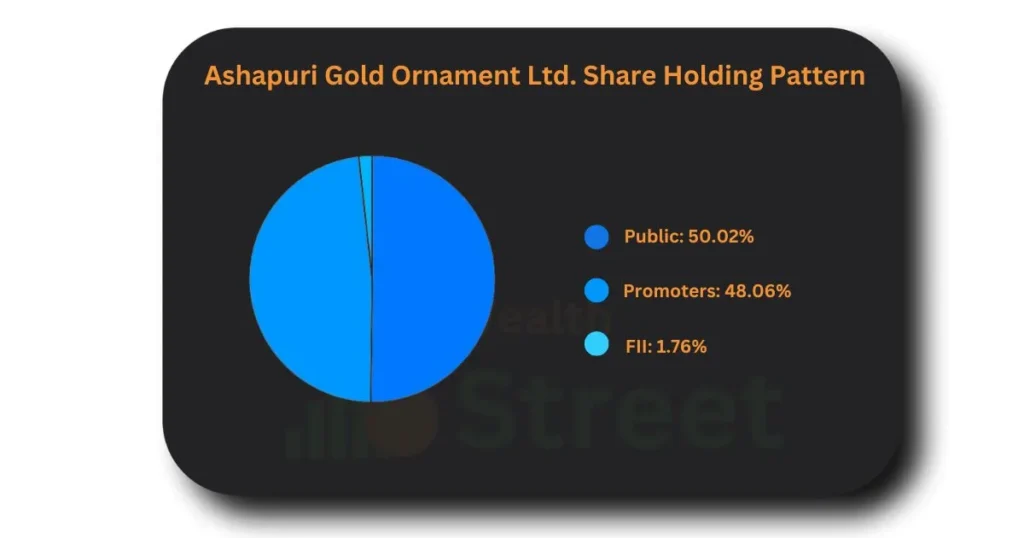

Ashapuri Gold Ornament Ltd. Share Holdings Pattern

Shareholding pattern is one of the most important factors for any share. In any company, a large number of shares are held by promoters, which shows the confidence of the promoter in that company, which is one of the positive signs of any company; high promoter holding shows greater control in the company’s decision.

Ashapuri Gold Share Price Target 2026 Growth Factors

To grow any company, multiple factors are responsible, such as economic factors, such as low inflation and interest rates, which increase consumers’ spending habits on buying luxury goods. These kinds of factors are not under the company’s control; these factors depend on the government, but there are many other factors for improvement on the company side that can capture more market, become profitable, and be stable.

There are some top Factors Impacting Ashapuri Gold’s Share Price Target by 2026

- Market Expansion: Expansion of the Market shows a positive impact on investors, indicates the company is doing well in the market, and it will be possible by focusing on the product and delivering promises. Follow market trends and find out consumers’ demands and fulfil them on time.

- Product Diversification: Diversification of products provides long-term stability in the market, and it also attracts more customers. The company currently manufactures gold. If in 2025 they manufacture silver and platinum ornaments, that can increase the company’s consumer base and revenue because many people also buy silver and platinum jewellery.

- Technological Advancements: In this technical era, running a business without taking advantage of technology drags down the business. Using new-generation machines helps to maintain quality and increase productivity in a minimum time, which can fulfil market demand in bulk.

- Availability on E-Commerce: Nowadays, most people are shifting to e-commerce for shopping, while the availability of products on e-commerce will scale sales across a wide range of reasons and attract more customers, which makes more revenue.

- Brand Partnership: Partnering with popular brands is also a good strategy for selling because it brings many new customers to the brand through the partnership.

Ashapuri Gold Share Price Target Technical and Fundamental Analysis

By Technical and Fundamental Analysis by experts. In the past 3 years, the company has shown a good profit rate, which is 42.30. % The company also shows minimum debt in the balance sheet, which has decreased recently.

The company also has some limitations, including its poor revenue growth of 11.99% in the past 3 years, and its ROI is 4.89% in the past 3 years.

In the table below, the expected range of Ashapuri Gold Share Price Target 2026 to 2030 is shown.

| Year | Share Price Target |

| 2026 | ₹ 16.41 |

| 2027 | ₹ 30.20 |

| 2028 | ₹ 35.93 |

| 2029 | ₹ 52.55 |

| 2030 | ₹ 74.26 |

Ashapuri Gold Share Price Target 2026 Expert Predictions and Analysis

The company is currently facing a recession in its stock. It is currently trading below ₹6, which is the previous resistance level of this stock. If this stock breaks this resistance, we can see some upside momentum. The estimated range of Ashapuri Gold Share Price Target 2026 is ₹6 to ₹16.41

In 2026, the company plans to expand its business in the remaining states, it’s also planning to diversify its portfolio in other various sectors, and it will also raise funds to expand its manufacturing unit, which gives positivity to investors.

| Duration | Share Price Target |

| January 2026 | ₹ 6.98 |

| February 2026 | ₹ 5.85 |

| March 2026 | ₹ 7.30 |

| April 2026 | ₹ 8.08 |

| May 2026 | ₹ 7.65 |

| June 2026 | ₹ 9.49 |

| July 2026 | ₹ 10.84 |

| August 2026 | ₹ 11.17 |

| September 2026 | ₹ 14.02 |

| October 2026 | ₹ 13.04 |

| November 2026 | ₹ 15.32 |

| December 2026 | ₹ 16.41 |

Ashapuri Gold Share Price Target 2030

Due to the growing economy, and salary hikes of employees will also increase their spending on luxury items they buy gold jewellery, silver, and platinum and Ashapuri Gold will be ready to fulfil their demand with its strong presence in the market, collaboration with brands, and focus on quality product, which can be made Ashapuri Gold leading player of jewellery manufacturer in India and its expected range of Ashapuri Gold Share Price Target 2030 will be

| Duration | Share Price Target |

| January 2030 | ₹ 53.14 |

| February 2030 | ₹ 54.33 |

| March 2030 | ₹ 56.94 |

| April 2030 | ₹ 58.04 |

| May 2030 | ₹ 62.96 |

| June 2030 | ₹ 64.11 |

| July 2030 | ₹ 68. 43 |

| August 2030 | ₹ 65.05 |

| September 2030 | ₹ 69.32 |

| October 2030 | ₹ 71.15 |

| November 2030 | ₹ 70.84 |

| December 2030 | ₹ 74.26 |

Peer Companies of Ashapuri Gold Share

- Goldkart Jewels

- Royal India Corp.

- Mini Diamonds

- Moksh Ornaments

- Patdiam Jewellery

- Golkunda Diamonds

- Starlineps Enter

- Swarnsarita Jewels

- Uday Jewellery

Also, Check

Gujarat Toolroom Share Price Target

FAQs

What is the Share Price Target of Ashapuri Gold in 2026?

If the market is favorable and the company focuses on its quality and profitability, then the expected range of its share can be ₹16.41 in 2025.

What is the (AGOL) Ashapuri Gold Share Price Target 2030 ?

Due to the demand for luxury items, the jewellery market will experience potential growth till 2030, and Ashapuri Gold’s expected price target will be ₹ 74.26.

What is the Expected Price Range of Ashapuri Gold Share in 2040?

The price Target of Ashapuri Gold till 2040 can touch the level of ₹300 because of the business diversification and expansion of its business.