Empower India BOM: 504351 Share Price Target came in trend in the past few years in recent years the company has provided a very good return to its investors, when we see its return in the long term it’s not soo good, in a long term company is loss-making if you want to know about Empower India Share Price Target 2025 then you came on a right article in this article we will get a complete overview of company fundamental, shareholding patterns and company historical performance.

Empower India Share Price Target 2025 to 2030 is based on the company’s historical performance and its technical and fundamental analysis, which will provide you with a brief knowledge of this company’s share price.

About Empower India Ltd.

Empower India Ltd. has a diversified business portfolio in India, it is a leading data center management company, its also provides green power solutions in India, the main business of the company is providing IT solutions which is a highly demanding sector in worldwide, some other business is to provide a solution (like actor, singer, musician, etc) in Bollywood and TV shows.

Empower India also offers the service Empower TradEX, which helps businesses to grow, increase sales, gain new customers, turn excess inventory into profit, improve cash flow, and win competition.

The company was established in 1981, and its name was Mahajan Trading Company. In 2003, its name was changed to Empower Industries Ltd., and again in 2011, its name changed to Empower India Limited. The company’s BSE code is 504351.

Empower India (BOM:504351) Share Financials Overview

| Company Essentials | Value |

| Market Cap | ₹ 246.73 Cr. |

| Enterprise Value | ₹ 246.66 Cr. |

| P/E | 74.39 |

| Book Value | ₹ 2.55 |

| Face Value | ₹ 1 |

| Debt | ₹ 0 |

| ROE | 0.06% |

| Sales Growth | 52.92% |

| Profit Growth | 306.29% |

| Dividend Yield | 0% |

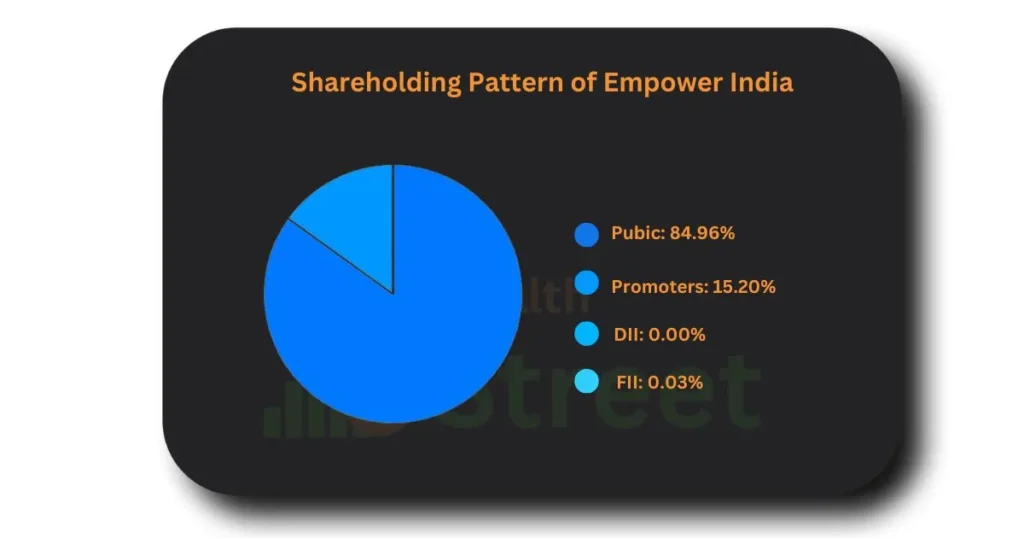

Shareholding Pattern of Empower India in 2025

The shareholding pattern of any share is one of the most important factors in shares. If we see the Empower India company, 84.96% of shares are in public hands, and 15.02% of shares are held by its promoters. FII holdings are 0.03% and DII holdings are 0%. If any company has 60% of its shares held by promoters, that is considered a stable company, but in a few sectors, this factor does not apply.

Empower India 2025 to 2030 Business Growth Factor

As per the business of Empower India, its sector has potential growth in the future because of its heavy demand in the Market, IT, Green Energy, Technical Support, etc. Here are some important factors that can provide a boost to Empower India’s business.

IT Solution: The company provides IT solutions and Infrastructure Data Management in India. Managing cloud data is one of the booming sectors worldwide because of the Internet and the advancement of technology. In the future, it will also be more demanding because people will use cloud storage instead of physical storage, stream online, and play online.

Business Solution: Empower India provides solutions to businesses to increase profit growth, generate leads, and provide consultancy through its Empower TradEX platform. In the upcoming years, this sector will also grow because many people want to start their businesses, and to increase their sales, they can use the services of Empower India Limited.

Power Generation (Green Energy): Green energy is also the most demanding sector in the upcoming year. The government provides many concessions for companies that have businesses in green energy to expand their business. India has a plan to reduce large amounts of carbon by 2030 to save the environment.

Empower India Ltd. Share Price Past Data (Technical)

Since the company has listened to the stock market, it has given good returns to its investors. When we see its price chart, its share started falling in 2011, and till August 2023, it didn’t give any return to its investors. In September 2023, it broke its resistance and came into an uptrend, and it became a multi-bagger stock in the past 4 years, giving 1,313,33% return. Here we can see the company’s historical chart and its Past 5-year returns data.

| In Short Term | In Long Term | ||

| 1 Week | -3.20% | 1 Year | 79.66% |

| 1 Month | -4.93% | 2 Years | 1,313.33% |

| 3 Months | -6.61% | 3 Years | 1,313.33% |

| 6 Months | -6.61% | 4 Years | 1,313.33% |

| 9 Months | 5.47% | 5 Years | 1,015.79% |

Empower India Ltd. Share Price Target 2025 to 2030

| Year | Share Price Target |

| 2025 | ₹ 6.64 |

| 2026 | ₹ 11.24 |

| 2027 | ₹ 18.30 |

| 2028 | ₹ 24.80 |

| 2029 | ₹ 29.10 |

| 2030 | ₹ 35.05 |

Empower India Share Target Price Range 2025

The company has focused on expanding its business, and its profit growth is 306.29%. In the past 3 years, it has reported a return of 1,313.33% and it has attracted new investors. The company is currently debt-free, and its financials are very stable. As per this analysis, the range of the Empower India Share Price Target 2025 is ₹ 3.86 to ₹ 6.64.

Empower India Share Price Target 2025

| Month 2025 | Share Price Target |

| January 2025 | ₹ 3.86 |

| February 2025 | ₹ 3.98 |

| March 2025 | ₹ 4.12 |

| April 2025 | ₹ 4.19 |

| May 2025 | ₹ 4.31 |

| June 2025 | ₹ 4.52 |

| July 2025 | ₹ 4.65 |

| August 2025 | ₹ 4.78 |

| September 2025 | ₹ 4.98 |

| October 2025 | ₹ 5.24 |

| November 2025 | ₹ 5.32 |

| December 2025 | ₹ 6.64 |

BOM: 504351 Empower India Share Target Price Range 2030

Empower India Ltd. offers its services in multiple countries and increases its customer base and profit growth. Its have multiple data centers worldwide, and it also offers solar module installation. In the long term, the company has given a decent return to its investors. As per this analysis, the Empower India Share Target Price Range 2030 will be ₹ 29.20 to ₹ 35.05.

Empower India Share Price Target 2030

| Months | Share Price Target |

| January 2030 | ₹ 29.20 |

| February 2030 | ₹ 29.48 |

| March 2030 | ₹ 29.80 |

| April 2030 | ₹ 30.12 |

| May 2030 | ₹ 30.74 |

| June 2030 | ₹ 30.98 |

| July 2030 | ₹ 31.40 |

| August 2030 | ₹ 31.90 |

| September 2030 | ₹ 32.80 |

| October 2030 | ₹ 33.50 |

| November 2030 | ₹ 34.21 |

| December 2030 | ₹ 35.05 |

Also Read

FAQs

What is the estimated share price target for Empower India in 2025?

The range of Empower India’s Share Price Target for 2025 is between ₹ 3.86 to ₹ 6.64.

What are the risks associated with investing in Empower India?

Risks associated with investing in Empower India are market volatility, competition from other tech companies, and government laws.

Is Empower India is debt free company?

Yes. as per the records Empower India has ₹0 debt.

Conclusion

In this article, we have read brief details about the Empower Share Price Target 2025 to 2030. We hope you are satisfied with the above article. If you need any help, kindly contact us. The company has had massive growth in the past 2 years and has become a multi-bagger stock. Currently, it is trading below its all-time high and it is a debt-free company.