Eraaya Lifespaces is a real estate development and property management company in India that provides hospitality and luxury space. Previously, the company was known as Justride Enterprises Ltd. In March 2024, its name was changed to Eraaya Lifespaces.

In this article, we provide a comprehensive overview of Eraaya Lifespaces Share Price Target for 2025 to 2030, the company’s key essentials, and its operational sector.

What does Eraaya Lifespaces Do?

In February 1967, the company was incorporated as Tobu Enterprises Private Limited. At that time, the company had business in kids’ tricycles and kids’ toys. In October 1987, the company became a public sector company in October 1987 In November 2013, Justride Enterprises Limited changed its business to offer digital marketing services. The company also expanded its business in real estate, providing hospitality and luxury space. In March 2024, the company changed its name to Eraaya Lifespaces.

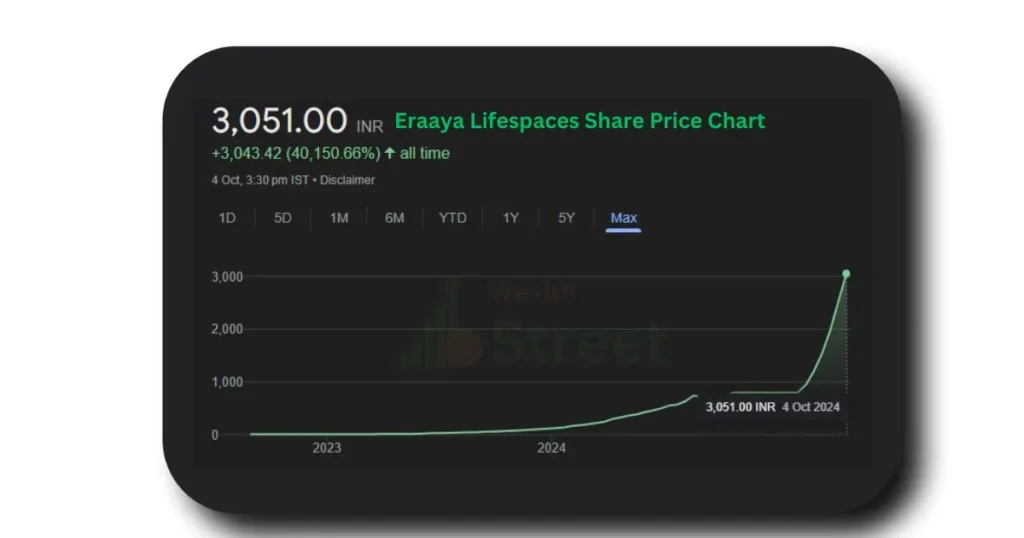

Eraaya Lifespaces Share Price Market Overview

| Company Essentials | Value |

| Market Cap | ₹5,609.07 Cr. |

| Enterprise Value | ₹5,609.78 Cr. |

| No. of Shares | 1.84 Cr |

| P/E | 4515.99 |

| P/B | 21.34 |

| Face Value | ₹10 |

| Book Value | ₹142.95 |

| Debt | ₹0.73 Cr |

| ROE | 0% |

| ROCE | 0% |

| Profit Growth | 226.36% |

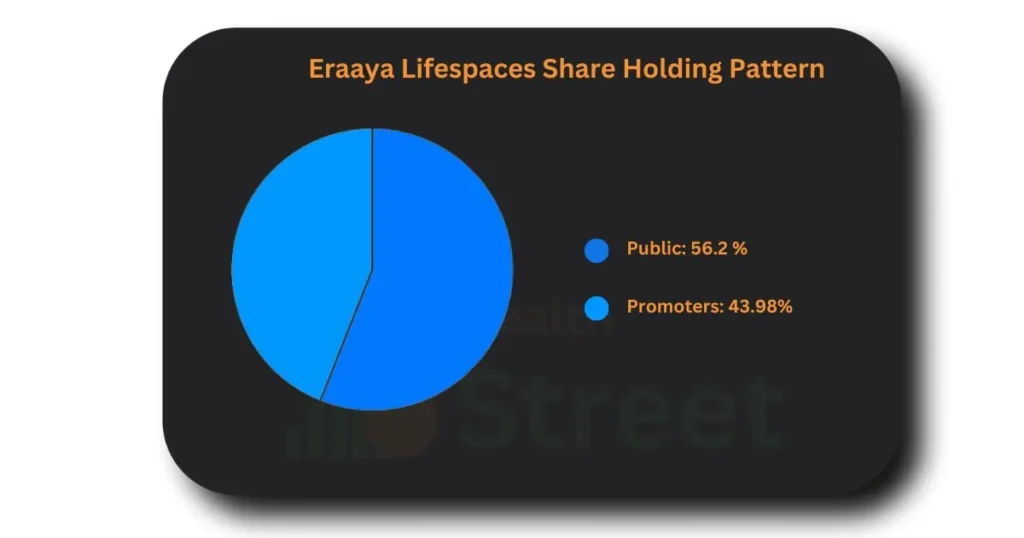

Eraaya Lifespaces Share Holding Pattern

The company promoter is holding discretion slowly, which is not a good sign. As per the technical company, a minimum of 60% of promoters’ holding is considered good, but decreasing numbers are not fair below the given picture. We can see the holding pattern of Eraaya Lifespaces.

Eraaya Lifespaces Share Price Growth Factor

For many days, the company’s shares have been trading on the upper circuit without any valid reason. Neither company has diversified its work in more than two sectors, but its ROCE of -21.14% over the past 3 years is not a good factor. The company also has negative cash flow from its operations, which is -0.64, and a negative book value. Currently, the company doesn’t have any positive strengths.

We do not recommend buying or selling this share just before taking any financial decision. Consult with your financial advisor or make any investment at your own risk.

Eraaya Lifespaces Share Price Target 2025 – 2030

| Year | Share Price Target |

| 2025 | ₹3867 |

| 2026 | ₹4670 |

| 2027 | ₹4925 |

| 2028 | ₹5489 |

| 2029 | ₹5910 |

| 2030 | ₹6134 |

Eraaya Lifespaces Share Price Target 2025 in Rupees

The estimated range of Eraaya Lifespaces Share Price Target 2025 in India Rupees is ₹3256 to ₹3867, which can also be lower.

| Duration | Share Price Target |

| January 2025 | ₹ 3256 |

| February 2025 | ₹ 3279 |

| March 2025 | ₹ 3341 |

| April 2025 | ₹ 3654 |

| May 2025 | ₹ 3578 |

| June 2025 | ₹ 3482 |

| July 2025 | ₹ 3580 |

| August 2025 | ₹ 3694 |

| September 2025 | ₹ 3715 |

| October 2025 | ₹ 3740 |

| November 2025 | ₹ 3802 |

| December 2025 | ₹ 3867 |

Eraaya Lifespaces Share Price Target 2030

As per the expert’s analysis, in most cases, long-term investments provide a better return to investors. Eraaya Lifespaces also has a long-term vision to expand its business and increase its company strength, so that it will be stable in the long term and provide a good return to its investors. The expected range of Eraaya Lifespaces Share Price Target 2030 India is ₹5480 to ₹6134.

| Duration | Share Price Target |

| January 2030 | ₹ 5480 |

| February 2030 | ₹ 5321 |

| March 2030 | ₹ 5203 |

| April 2030 | ₹ 5340 |

| May 2030 | ₹ 5462 |

| June 2030 | ₹ 5533 |

| July 2030 | ₹ 5610 |

| August 2030 | ₹ 5773 |

| September 2030 | ₹ 5879 |

| October 2030 | ₹ 5914 |

| November 2030 | ₹ 6002 |

| December 2030 | ₹ 6134 |

Pros

The company currently doesn’t have any positive strength to grow in the future.

Cons

- The company has lower sales day by day.

- Company Asset is decreasing

- It has had poor ROCE of -21.14% over the past 3 years

- High debtor days of 357.70.

- The company is trading at a high EV/EBITDA of 3,202.21.

Also Read

Tata Power Share Price Target 2025

FAQs

Eraaya Lifespaces is a good investment decision in 2025.

Currently not any technical analyst givesa a buy ration to Eraaya Lifespaces.