K Lifestyle is an India-based fabric manufacturer. It was publicly listed on 12 August 1987. The company manufactures various types of knitted fabrics, cotton spun yarn, doubled yarn, texturized yarn, etc, and supplies to garment manufacturers and exporters. In this article, we will read complete details about the K Lifestyle Share Price Target 2025, 2030, and 2040. We will also get its fundamental overview, shareholding pattern, and short- and long-term returns.

Fundamental Overview of K Lifestyle and Industries Ltd (KLIF)

| Company Essentials | Value |

| Market Cap | ₹ 35.78 Cr. |

| Enterprise Value | ₹ 361.75 Cr. |

| No. Of Shares | 102.24 Cr. |

| P/E | 0 |

| P/B | 0 |

| Face Value | ₹ 1 |

| Book Value | ₹ 0 |

| Debt | ₹ 326.26 Cr. |

| EPS | ₹ -0.56 |

| ROE | 0% |

| ROCE | -5.89% |

| Sales Growth | -70.55% |

| Profit Growth | -73.72% |

| Dividend Yield | 0% |

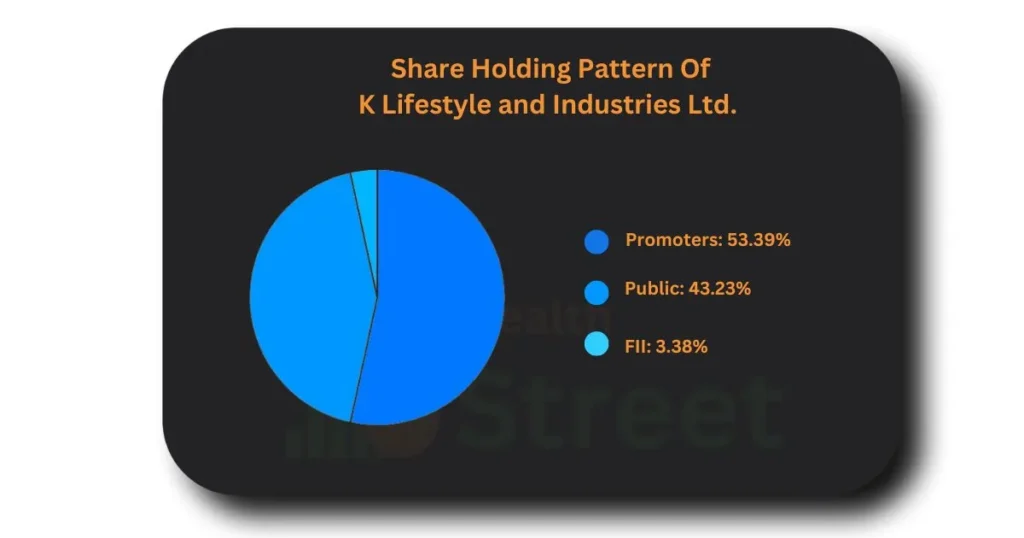

Share Holding Pattern of K Lifestyle

If we see the holding pattern of the company, 53.39% of shares are held by its promoters, which means promoters are expecting the growth of the company in the future, 43.23% shares of the company are held by the public investors, and 3.38% share is held by Domestic Institutional Investor (DII).

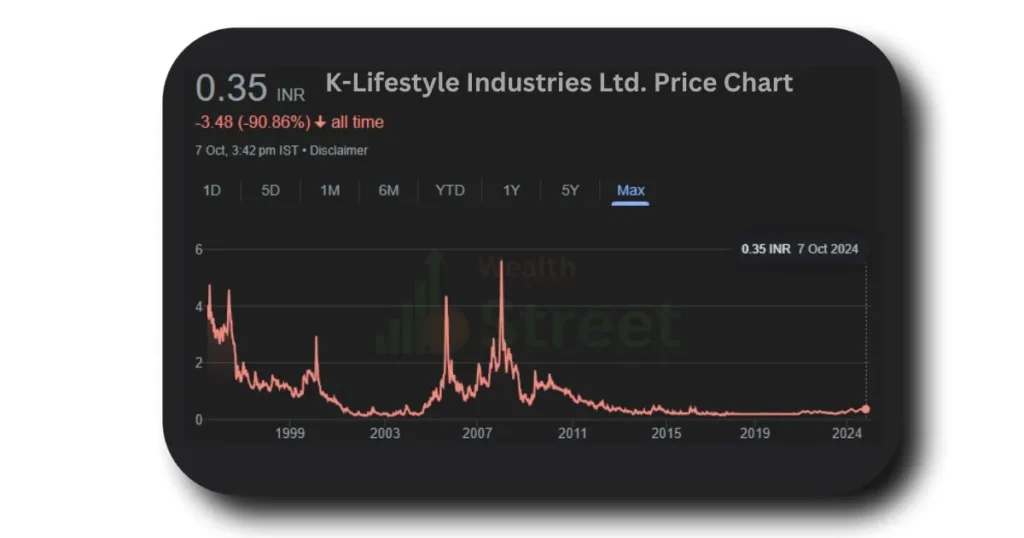

K Lifestyle Investment Return in Past 1 Year

Since the company is listed as public its did not give good returns to its investors, due to only being listed on BSE and having poor financial management company has had liquidity issues in its shares in 3 years company has given a return of 84.21% to its investors, in 1 year its 29.63% which is a decent return but its too risky to invest in this share because company financials are very bad.

Potential and Growth Factor of K Lifestyle

It does not look like the company will be stable and grow in the future because of its poor financials. The company’s valuation is ₹ 361.75 Cr., and its debt is ₹ 326.26 Cr. First, the company needs to reduce its debt and focus on profitability since it has been making losses and has a negative book value.

K Lifestyle Share Price Target 2025 to 2040

| Year | Share Price Target |

| 2025 | ₹ 0.42 |

| 2026 | ₹ 0.55 |

| 2027 | ₹ 0.70 |

| 2028 | ₹ 0.87 |

| 2029 | ₹ 0.63 |

| 2030 | ₹ 0.97 |

| 2040 | ₹ 1.07 |

K Lifestyle Share Price Target 2025

| Duration | Share Price Target |

| January 2025 | ₹ 0.35 |

| February 2025 | ₹ 0.28 |

| March 2025 | ₹ 0.25 |

| April 2025 | ₹ 0.22 |

| May 2025 | ₹ 0.19 |

| June 2025 | ₹ 0.23 |

| July 2025 | ₹ 0.25 |

| August 2025 | ₹ 0.28 |

| September 2025 | ₹ 0.36 |

| October 2025 | ₹ 0.34 |

| November 2025 | ₹ 0.39 |

| December 2025 | ₹ 0.42 |

K Lifestyle Share Price Target 2030

| Duration | Share Price Target |

| January 2030 | ₹ 0.63 |

| February 2030 | ₹ 0.68 |

| March 2030 | ₹ 0.73 |

| April 2030 | ₹ 0.78 |

| May 2030 | ₹ 0.83 |

| June 2030 | ₹ 0.75 |

| July 2030 | ₹ 0.67 |

| August 2030 | ₹ 0.72 |

| September 2030 | ₹ 0.84 |

| October 2030 | ₹ 0.89 |

| November 2030 | ₹ 0.91 |

| December 2030 | ₹ 0.97 |

K Lifestyle Share Price Target 2040

| Duration | Share Price Target |

| January 2030 | ₹ 0.48 |

| February 2030 | ₹ 0.39 |

| March 2030 | ₹ 0.50 |

| April 2030 | ₹ 0.59 |

| May 2030 | ₹ 0.68 |

| June 2030 | ₹ 0.75 |

| July 2030 | ₹ 0.81 |

| August 2030 | ₹ 0.88 |

| September 2030 | ₹ 0.96 |

| October 2030 | ₹ 0.93 |

| November 2030 | ₹ 1.02 |

| December 2030 | ₹ 1.07 |

Pros

If we see the company’s strength currently, are there any pros looking at the company’s fundamentals, except for its promoter holding, which is 53.39%.

Cons

- The company has a negative book value.

- EBITDA margin has been 2.80% in the past 5 years.

- Profit growth of the company in the past 3 years is -0.35%.

- Revenue growth of the company in the past 3 Years is -64.04%.

- ROE is 0% in the past 3 years.

- ROCE is -22.05% in the past 3 years.

Conclusion

In this article, we have read a complete overview of K Lifestyle Share Price Target 2025, its pros and cons, its growth factor, the company’s fundamental overview, and its shareholding pattern. If we consider value investing, K Lifestyle is not a fit for it because of its very poor fundamentals. The company has always been making losses since it became publicly traded, and most of its values are negative.

Also, Check

Diamond Power Share Price Target

FAQs

What is the business of K-Lifestyle?

K Lifestyle is engaged in the textile business; it manufactures knitted fabrics, cotton spun yarn, doubled yarn, and texturized yarn.

What is the market cap of K-Lifestyle Industries Ltd.?

The market cap of K-Lifestyle Industries Ltd. is ₹ 35.78 Cr.

Is K-Lifestyle Industries Ltd. profit-making company?

No K-Lifestyle Industries Ltd. is loss a loss-making company for past many years.