Refex Share Price Target: Refex Industries Limited is the manufacturer of refills of Refrigerant gases, which are alternatives to Chloro-fluoro-carbons (CFCs) like R-134a, R-404a, R-407c, R-410a, R-22, and R-32, which are not as harmful to the environment as CFCs. Refex is an industry leader in manufacturing R-134a cans, which are widely used.

Refex Industries’ stock is a multi-bagger stock; previously, it has given good returns to its investors. In this article, we will get a complete overview of REFEX Industries’ share price targets for 2025, 2030, and 2040. We will also learn about the company’s business vertical, its growth factors, shareholding pattern, and its fundamental overview.

What does Refex Industries Limited (RIL) Do?

Refex Industrie is a core manufacturer of refrigerant gases, which are used as refrigerants, foam-blowing, and aerosol propellants. Now, these gases are widely used in India instead of CFCs, and Refex Industries Limited is a leader in manufacturing these gases for commercial use.

The company has diversified its business into multiple sectors, such as coal ash handling and power trading. Its subsidiary companies are Refex Green Mobility Limited and Vituza Solar Energy. The company was established in September 2002, and it was publicly listed in 2009.

Refex Industries Share Price Market Overview

| Company Essential | Value |

| Market Cap | ₹ 5,958.88 Cr. |

| Enterprise Value | ₹ 6,022.19 Cr. |

| No. Of Shares | 12.07 Cr. |

| P/E | ₹51.86 |

| P/B | ₹10.44 |

| Face Value | ₹2 |

| Book Value | ₹ 47.29 |

| Debt | ₹ 96.20 Cr. |

| EPS | ₹ 9.52 |

| ROE | 25.67% |

| ROCE | 32.77% |

| Sales Growth | -15.87% |

| Profit Growth | -13.02% |

| Dividend Yield | 0.1% |

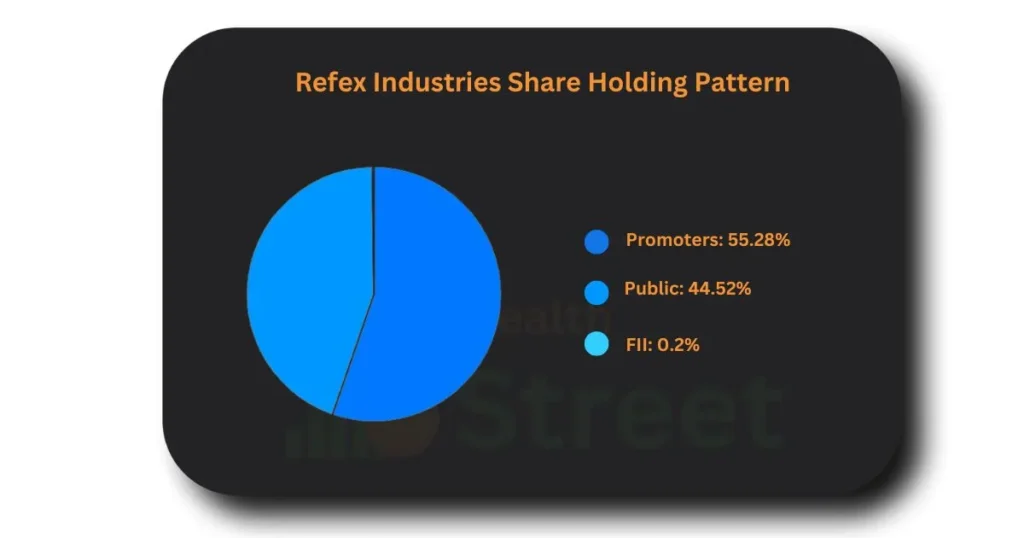

Refex Industries Share Holding Pattern

When we see the shareholding pattern of Refex Industries, a large number of shares are held by promoters, which is 55.28% and they have continuously increased their holding in the past few years, which is good. 44.52% of company shares are in public, 0.2% are held by FII, and the remaining shares are held by mutual fund houses.

In the company balance sheet, we can see that 16.34% of shares are pledged, which is considered not good for an investor.

Refex Industries Share Growth Factors

Refex Industries Limited is one of the fastest-growing companies in India. In the past 5 years, it has given a 4,455,31% return to its investors, and it’s come in the list of multi-bagger stocks. After that, it came to the eyes of investors, and buying increased in this stock.

The company has business in manufacturing environmentally safe refrigerator gas, which is in high demand nowadays, as well as in the future, also, because every year the temperature increases and AC and Refrigerator sales also increase, which will also impact the sales of Refex Industries because it manufactures its gases.

The company has business in the solar power sector, which is also in demand for energy sources. The Indian government has a plan to reduce carbon emissions, and the government promotes industries that are based on green energy.

Refex Industries Share Price Target 2025 TO 2030, 2040

As per technical indicators, the company got a buy rating on its shares, but if we consider value investing, then it came in a high valuation because its P/E is too high, which is 51.86. Below, we will see the expected range of Refex Industries Share Price Target 2025 TO 2040.

| Year | Share Price Target |

| 2024 | ₹ 601.30 |

| 2025 | ₹ 1143 |

| 2026 | ₹ 1887.20 |

| 2027 | ₹ 2460.70 |

| 2028 | ₹ 3240.55 |

| 2029 | ₹ 4010.64 |

| 2030 | ₹ 4827.04 |

| 2040 | ₹ 12425.98 |

Refex Industries Share Price Target 2025

Refex Industries is planning to reduce its debt and focus on its profit growth. It will expand its business outside of India to capture some part of the global market, which will make the company profitable in this business, and that will also impact the company’s shares. The expected range of the Refex Industries Share Price Target 2025 can be ₹ 650.44 to ₹ 1143.

| Duration | Share Price Target |

| January 2025 | ₹ 650.44 |

| February 2025 | ₹ 703.12 |

| March 2025 | ₹ 745.10 |

| April 2025 | ₹ 816.82 |

| May 2025 | ₹ 894.70 |

| June 2025 | ₹ 947.31 |

| July 2025 | ₹ 986 |

| August 2025 | ₹ 860.02 |

| September 2025 | ₹ 941.77 |

| October 2025 | ₹ 1022 |

| November 2025 | ₹ 1082.67 |

| December 2025 | ₹ 1143 |

Refex Industries Share Price Target 2030

Till 2030, Refex Industries wants to become a market leader in India for the manufacturing of refrigerant gas, and it will also focus on getting more contract power sector companies that are based on coal to handle their ash and generate revenue. The company already focuses on its quality and customer satisfaction, making a positive impact on company shares. The expected range of the Refex Industries Share Price Target 2030 can be ₹ 4050 to ₹ 4827.04.

| Duration | Share Price Target |

| January 2026 | ₹ 4050 |

| February 2026 | ₹ 4087.23 |

| March 2026 | ₹ 4130.22 |

| April 2026 | ₹ 4198 |

| May 2026 | ₹ 4261.08 |

| June 2026 | ₹ 4357.28 |

| July 2026 | ₹ 4451.49 |

| August 2026 | ₹ 4564.82 |

| September 2026 | ₹ 4683.44 |

| October 2026 | ₹ 4731.86 |

| November 2026 | ₹ 4776.25 |

| December 2026 | ₹ 4827.04 |

Refex Industries Share Price Target 2040

Due to technological enhancement and advanced logistics, a professional team company will satisfy customers by fulfilling their demands, and the company has experienced exponential growth. The company has increased its filling and storage capacity to work on a large scale. Till 2040, company shares will touch a new high. Its expected range of Refex Industries Share Price Target 2040 can be ₹10562 to ₹ 12425.98

| Duration | Share Price Target |

| January 2027 | ₹ 10562 |

| February 2027 | ₹ 10743 |

| March 2027 | ₹ 11123.60 |

| April 2027 | ₹ 10942.16 |

| May 2027 | ₹ 11178 |

| June 2027 | ₹ 11487 |

| July 2027 | ₹ 11655 |

| August 2027 | ₹ 11380 |

| September 2027 | ₹ 11549 |

| October 2027 | ₹ 11879 |

| November 2027 | ₹ 12140 |

| December 2027 | ₹ 12425.98 |

Pros

- The company’s ROE is 33.44% over the past 3 years.

- The company’s ROCE has been 45.11% over the past 3 years.

- Profit growth of 35.09% for the past 3 years.

- Revenue growth is 29.39% in the Past 3 years.

- The current ratio liquidity position is 2.73.

Cons

- Promoter has increased their pledging of shares 6.31% to 16.34% in 1 quarter.

- Cash flow operations are -4.49.

- The company is trading at a high EV/EBITDA of 32.92.

Also Read

K Lifestyle Share Price Target

FAQs

What is Refex Share price target in 2030?

The expected range of the Refex Industries Share Price Target 2030 can be ₹ 4050 to ₹ 4827.04.

What is the market cap of Refex Industries Limited?

The market cap of Refex Industries Limited is ₹ 5,958.88 Cr.