About the Company: Swan Energy has a diversified business portfolio. The company operates in multiple sectors, such as Shipbuilding and Heavy Engineering, Real Estate, Textiles, Oil and Gas, and Petrochemicals. It was established in 1909 and is currently focusing on expanding its LNG and Real Estate business in India.

In this article, we will get complete insight into Swan Corp Share Price Target 2026, the company fundamentals, its growth factors, and its market overview. To start investing in any company, knowing the fundamentals and techniques of the company is very important, which is what makes value investing.

Swan Corp Ltd. Share Price Target 2026 Market Overview

| Company Essentials | Value |

| Market Cap | ₹ 14,575.75 Cr. |

| Enterprise Value | ₹ 14,894.35 Cr |

| No. Of Shares | ₹ 31.35 Cr |

| P/E | 813.51 |

| P/B | 3.18 |

| Face Value | ₹ 1 |

| Book Value | ₹ 146.11 |

| Debt | ₹ 373.88 |

| EPS | ₹ 0.57 |

| Sales Growth | -64.89% |

| ROE | 0.20% |

| ROCE | 0.30% |

| Profit Growth | 316.70% |

| Dividend Yield | 0.02% |

Growth Factors of Swan Corp in 2026

There are multiple factors that are responsible for growth in any company, such as the sector in which the company has a business, whether that sector has a future or not, whether the sector is a more demanding sector, whether the company diversifies its business or not, etc. Below is the list of what can be responsible for the future growth of Swan Corp (Swan Energy) in 2026.

- Expansion in the LNG Sector: Swan Energy focuses on its business in the LNG sector and its Floating Storage and Regasification Unit. As we know, natural gas is very important for everyone. Now we use it in our household, and it is also widely used in industries because it is a clean energy source, and clean energy is in high demand in the future. Focusing on LNG helps the company to shift from coal and oil to clean energy sources.

2. Government Initiatives and Policies Supporting Clean Energy: The Indian government promotes cleaner energy sources to reduce carbon emissions, which is a leverage for the company. The Indian Government focuses on making 15% of energy through natural gas by 2030. To participate in this opportunity, Swan Energy is ready and it can get its benefit. The government provides a subsidy for ongoing future projects related to clean energy.

3. Diversification into Heavy Engineering, Shipbuilding, Real Estate, and Textiles: Swan Energy diversified its business into multiple sectors, which is good for investors. If its core energy business is down, that other sector can perform well to stay in the market. The company also has a shipyard in Pipavav, which is the largest dry dock in India.IN 2021, it also started a textile business, where they produce a wide range of best-class fabric.

4. Growing Demand for LNG in India: The Consumption of energy in India is increasing day by day, and demand for LNG has also increased. Swan Energy’s investments in LNG terminals and regasification units, which can fulfill the demand of LNG in India, will enable it to gain long-term supply contracts from International buyers as well as domestic buyers. The government also helps these kinds of companies to grow the green energy business in India.

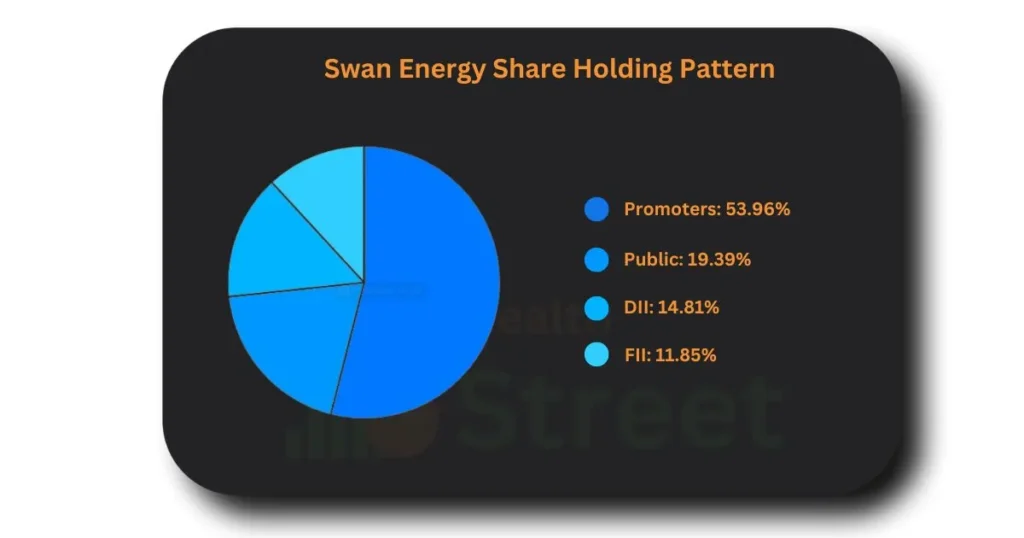

Shareholding Pattern of Swan Corp Ltd

Swan Corp’s holding pattern is fair since the holding pattern of promoters is stable since 2024, as comparision of 2023 promoters is decreasing, as well as FII and DII are also decreasing their holding, and retail investors are increasing their stakes. Below, we can see the holding pattern of Swan Energy in the given table.

Swan Corp Share Price Forecast 2026 to 2030

As per the technical in the monthly chart, we see selling in this stock, but company ownership is stable, and its financials are average for the short term. This share may not be profitable, but in the long term, we can make a decent profit from this share. In the given table, we can see Swan Corp Share Price Target 2026 to 2030, from which we can get an idea about its price target.

| Year | Share Price Target |

| 2026 | ₹ 630.60 |

| 2027 | ₹ 788.42 |

| 2028 | ₹ 574.11 |

| 2029 | ₹ 902.35 |

| 2030 | ₹ 1648.50 |

Swan Corp Ltd Peer Comparison

Below is the list of peer companies that are the competitors of Swan Energy.

- MRO-TEK Reality

- K.P.R. Mill

- Vedant Fashions

- Welspun Living

- Raymond Lifestyle

- Vardhman Textiles

- Alok Ind

- Arvind

- Andrew Yule & Company

- Empire Industries

- Tara Chand Infra Logistic Solutions

Swan Corp Share Price Target 2026

In 2026, we can see uptrend momentum in Swan Energy stock because of its strategic initiative, which is focused on expanding its LNG business and expanding its real estate and textile portfolio, which can have an effect on its share. The range of Swan Energy Share Price Target 2026 is ₹ 470 to ₹ 630.60.

| Duration | Share Price Target |

| January 2026 | ₹ 470.85 |

| February 2026 | ₹ 482.14 |

| March 2026 | ₹ 504.08 |

| April 2026 | ₹ 529.86 |

| May 2026 | ₹ 538.50 |

| June 2026 | ₹ 552.11 |

| July 2026 | ₹ 579.32 |

| August 2026 | ₹ 595.70 |

| September 2026 | ₹ 582.41 |

| October 2026 | ₹ 602.39 |

| November 2026 | ₹ 619.88 |

| December 2026 | ₹ 630.60 |

Swan Corp Share Price Target 2030 in India

In the long term, most of the value investing gives decent returns to investors. Due to the strong stability of the company in the market, Swan Corp can give a good return to its investors if the company focuses on reducing its debt, increasing its profit growth, attracting new investors, and expanding its business till 2030. The expected range of the Swan Corp Share Price Target 2030 is

| Duration | Share Price Target |

| January 2030 | ₹ 1459.50 |

| February 2030 | ₹ 1471.98 |

| March 2030 | ₹ 1485.30 |

| April 2030 | ₹ 1508.15 |

| May 2030 | ₹ 1532.02 |

| June 2030 | ₹ 1560.88 |

| July 2030 | ₹ 1574.32 |

| August 2030 | ₹ 1587.46 |

| September 2030 | ₹ 1579.08 |

| October 2030 | ₹ 1603.11 |

| November 2030 | ₹ 1614.35 |

| December 2030 | ₹ 1648.50 |

Also Check

Jio Finance Share Price Target

Note: Before taking any financial decision, please contact your registered financial advisor and take the risk at your own risk. Don’t take investment decisions based on just this article; we didn’t recommend buying this stock. We just wrote this article for knowledge purposes only.

FAQs

What is the expected share price target Swan Corp for 2026?

On the basis of market trends, analysts predict Swan Corp’s share price could reach ₹ 630.60 by 2026. Some external factors also affect business growth and sector developments, such as the budget, tax, and government policies.

Can Swan Corp’s Share Grow by 2030?

With its expansion into LNG projects and diversification into real estate and textiles, the Company can achieve substantial growth, and its price can reach ₹ 1648.50 by 2030.

Is Swan Corp a good investment for long-term till 2030?

Business diversification into multiple sectors, and focus on clean energy, LNG infrastructure, Swan Corp can get a potentially strong uptrend in the long-term and provide decent returns to its investors till 2030.