Reliance Power is a subsidiary company of Reliance Group, which is managed by Anil Dhirubhai Ambani and his sons. RPOWER has the largest power generation portfolio under development in the private sector in India. The company was established in 1995. At that time, its name was Bawana Power Limited. In 2007, the company name was changed to Reliance Power Limited.

The Company operates multiple power plants across the country, these are coal-based Thermal Power Projects, gas-based Thermal Power Projects, and also Renewable energy projects, Solar, Windmill, and Hydroelectricity Projects.

In this article, we will get a complete overview of Reliance Power Share Price Targets for 2024, 2025, 2026, 2027, 2028, 2029, 2030, and 2040.

Market Overview Rpower Share Price

| Company Essential | Values |

| Market Cap | ₹20, 526.72 Cr. |

| No. of Shares | 401.70Cr |

| PE | 402.05 |

| P/B | 2.18 |

| Face Value | ₹10 |

| Book Value | ₹23.24 |

| Debt | ₹4,199.83 Cr |

| Promoter Holding | 23.24% |

| ROE | 0.49% |

| Dividend | 0% |

Reliance Power Stock Growth Factors

As we see many power generation companies are diversifying their business in Renewable energy because in upcoming years are the time for renewable energy because many countries want carbon-free countries as well as India and we can see the price difference in Reliance Power Stock Price Target 2025-2023 because company focus on its growth and recently its pay its debt and it is the good signal for investors.

In the above chart we can see reliance power gives a 1985% return in the past five years since the company paid its debt many new investors came and its share spiked rapidly.

Long-Term Growth: Focus on Renewable Energy Expansion

The company focuses on its long-term growth and investing in the Renewable energy sector. We all know upcoming years are the future of green energy, and the company knows this, so it focuses on Solar Projects, Hydroelectricity, and wind projects.

Investments in Clean Energy

Focusing on Environmental, Social, and Governance (ESG) standards in the global market demand for adopting clean energy, Reliance Power is expanding its investment in the renewable energy sector. The government also promotes renewable energy and provides subsidies to consumers for solar installation.

Capacity Expansion and Debt Reduction

Reliance Power is positioning itself for growth with capacity expansion and is also focusing on debt reduction. Now, it has enhanced its strategies in its power generation capacity, especially via renewable energy projects. By increasing its capacity in clean energy, such as solar, wind, and hydroelectric energy production, the company can capture a larger share of the growing demand for clean energy in India.

Reliance Power has been actively focusing on reducing its debt. As per recent data, the news agency says it also pays most of the debt, which is a positive signal for its investors. Now it’s allowing the company to focus on more capital-efficient investments. This dual approach of capacity building and financial prudence not only boosts investor confidence but also positions Reliance Power as a more agile and competitive player in the energy sector.

Bets on Solar and Wind Projects

Reliance Power is placing bets on solar and wind energy projects to achieve growth in India’s rapidly competitive energy market. India is aggressively pursuing renewable energy targets, and solar and wind energy are becoming the main sources of power infrastructure in the future. Reliance Power identified this opportunity, and it focuses on scaling its solar and wind portfolios to fulfill the rising demand for sustainable power solutions.

New policies of the Government have made these energy sources more cost-effective and attractive for consumers and producers. As a result, Reliance Power’s strategic focus is on these sectors to provide a sustainable growth path. Renewable energy consumption in India is expected to continue its upward momentum. Reliance Power Solar and its wind projects position it well for long-term growth.

Read Also :- RVNL Share Price Target 2025, 2035, 2030, 2040 To 2050

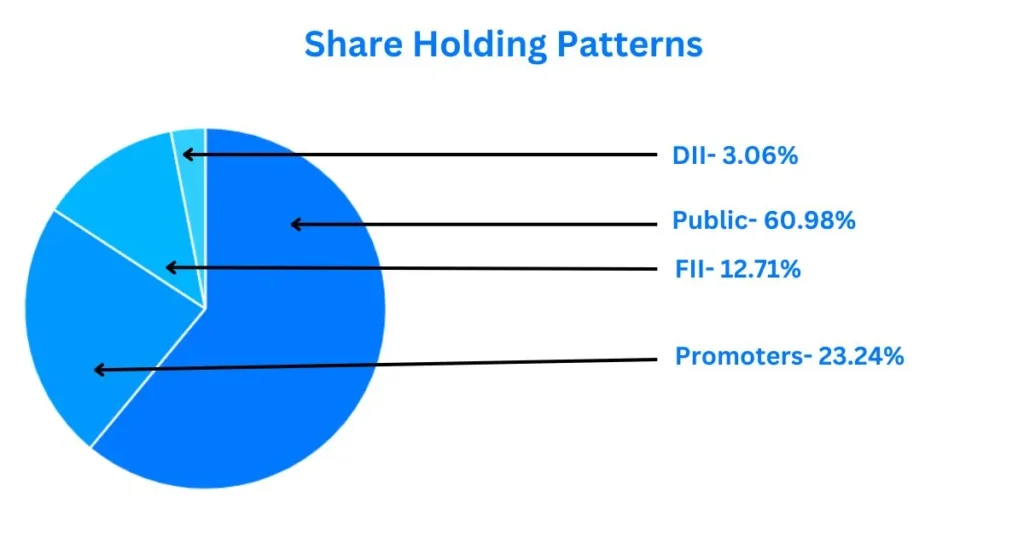

Reliance Power Share Holding Pattern

Shareholding patterns are also an important factor in investing, as top analysts consider shares that have high promoter holdings, which we can keep on our watchlist; not just seeing this factor, we can invest. High promoters’ holdings show a strong belief among promoters that their company will grow in the future.

In the above image, the stock holding pattern of investors Reliance Power Limited shows that most of the shares are held by the public, which is 60.98% of all its shares, 23.24% shares are held by promoters, 12.71% shares are held by FII, and 3.06% held by DIIs.

(Rpower) Reliance Power Share Price Target 2025 -2030

Multiple factors are responsible for any share to sustain in the market and give decent returns. We didn’t say the exact value of any share, but as per technical research, we can expect these price targets. Below we can see the Reliance Power stock price target 2025 -2030.

| Year | Share Price Target |

| 2025 | ₹72 |

| 2026 | ₹90 |

| 2027 | ₹108 |

| 2028 | ₹125 |

| 2029 | ₹151 |

| 2030 | ₹184 |

Reliance Power Peer Comparison

- NTPC

- Power Grid Corporation of India

- Adani Green Energy

- Adani Power

- Tata Power

- JP Power Ventures

- GMR Power and Urban

- RattanIndia Power

- Power Grid Corporation of India

- Torrent Power

- JSW Energy

Reliance Power Share Price Target 2025

As per the analysis we can expect the range of Reliance Power Share to be Between ₹59.4 to ₹84 in 2025.

| Duration | Share Price Target |

| January 2025 | ₹59.4 |

| February 2025 | ₹62.50 |

| March 2025 | ₹65 |

| April 2025 | ₹74 |

| May 2025 | ₹56 |

| June 2025 | ₹68 |

| July 2025 | ₹71 |

| August 2025 | ₹63.54 |

| September 2025 | ₹77 |

| October 2025 | ₹80 |

| November 2025 | ₹81.32 |

| December 2025 | ₹84 |

RPOWER Share Price Target 2030

A long-term investment is considered a good investment because, as per data, investors who get decent returns on their investments invest in the long term. Below we can see the Reliance Power Share Price Target 2030.

| Duration | Share Price Target |

| January 2025 | ₹174 |

| February 2025 | ₹178.22 |

| March 2025 | ₹180.05 |

| April 2025 | ₹184 |

| May 2025 | ₹186.30 |

| June 2025 | ₹189 |

| July 2025 | ₹192 |

| August 2025 | ₹188 |

| September 2025 | ₹191.90 |

| October 2025 | ₹194 |

| November 2025 | ₹196 |

| December 2025 | ₹197.85 |

Conclusion

In this article, we have read a complete overview of the Reliance Power Share Price Target. We all know that in a few years, RPower will give huge returns. Now it comes in the multi-bagger stock category since the company is free now, and more investors are showing their interest in this stock. Now the company’s main focus is on expanding its business and making a company list. If the company is doing well and fulfills market demand, we can expect its growth in the future.

Frequently Asked Questions

What is the future of Reliance Power Share Price Target in 2025?

The expected future of Reliance Power Limited in 2025 is bullish because the company has paid all its debt and is now debt-free, focusing on its new business model. Investors keeping their eyes on this stock, we can expect its price to be ₹75 to 174 in 2025.

What is the share price of Reliance Power in 2040?

The expected price of Reliance Power in 2040 is ₹2300 to ₹4000.