Jaiprakash Power Ventures (JP Power) is a subsidiary company of the Jaypee Group. It was established in 1994. The company has business in Hydro Power generation, Thermal Power Generation, Coal Mining, and Cement Grinding. Currently, the company has a total operating capacity of 2220 MW through its three power plants. In this article, we will get a complete overview of JP Power Share Price Target 2025, 2030, 2040, and 2050. We can also read the company fundamentals, shareholding patterns, and its growth factors through this article.

Market Overview of Jaiprakash Power Ventures Ltd.

| Company Essentials | Value |

| Market Cap | ₹ 13, 638.38 Cr. |

| Enterprise Value | ₹ 16, 928.43 Cr. |

| No Of Shares | 685.35 Cr. |

| P/E | 16.18 |

| P/B | 1.7 |

| Face Value | ₹ 10 |

| Book Value | ₹ 11.69 |

| Debt | ₹ 4,241.79 Cr. |

| ROE | 9.37 % |

| ROCE | 8.72% |

| Profit Growth | 1,062.49% |

| Sales Growth | 16.87% |

| Dividend Yield | 0% |

JP Power Share Price Target 2025 to 2050

Here is the list of JP Power Share Price Target from 2025 to 2030, 2035, 2040, and 2050 as per the research of the company fundamentals and technical analysis.

| Year | Share Price Target |

| 2025 | ₹ 54.16 |

| 2026 | ₹ 83.50 |

| 2027 | ₹ 162.30 |

| 2028 | ₹ 210.75 |

| 2029 | ₹ 294.35 |

| 2030 | ₹ 362.21 |

| 2035 | ₹ 626.40 |

| 2040 | ₹ 910.15 |

| 2050 | ₹ 1468.30 |

JP Power Share Price Target 2025

| Duration | Share Price Targe |

| January 2025 | ₹ 31.29 |

| February 2025 | ₹ 36.84 |

| March 2025 | ₹ 42.10 |

| April 2025 | ₹ 38.05 |

| May 2025 | ₹ 42.40 |

| June 2025 | ₹ 44.80 |

| July 2025 | ₹ 47.05 |

| August 2025 | ₹ 50 |

| September 2025 | ₹ 48.30 |

| October 2025 | ₹ 49.75 |

| November 2025 | ₹ 52.41 |

| December 2025 | ₹ 54.16 |

JP Power Share Price Target 2030

| Duration | Share Price Target |

| January 2030 | ₹ 298.20 |

| February 2030 | ₹ 308.45 |

| March 2030 | ₹ 319.32 |

| April 2030 | ₹ 328.76 |

| May 2030 | ₹ 330 |

| June 2030 | ₹ 342.40 |

| July 2030 | ₹ 355.19 |

| August 2030 | ₹ 348.20 |

| September 2030 | ₹ 357.10 |

| October 2030 | ₹ 342.40 |

| November 2030 | ₹ 356.80 |

| December 2030 | ₹ 362.21 |

JP Power Share Price Target 2035

| Duration | Share Price Target |

| January 2035 | ₹ 510 |

| February 2035 | ₹ 493.42 |

| March 2035 | ₹ 485.03 |

| April 2035 | ₹ 495.20 |

| May 2035 | ₹ 518.91 |

| June 2035 | ₹ 539.45 |

| July 2035 | ₹ 558.76 |

| August 2035 | ₹ 574.20 |

| September 2035 | ₹ 584.92 |

| October 2035 | ₹ 595.80 |

| November 2035 | ₹ 604.15 |

| December 2035 | ₹ 626.40 |

JP Power Share Price Target 2040

| Duration | Share Price Target |

| January 2040 | ₹ 803.26 |

| February 2040 | ₹ 816.41 |

| March 2040 | ₹ 827.33 |

| April 2040 | ₹ 832.81 |

| May 2040 | ₹ 848.20 |

| June 2040 | ₹ 862.70 |

| July 2040 | ₹ 874.41 |

| August 2040 | ₹ 887.55 |

| September 2040 | ₹ 893.08 |

| October 2040 | ₹ 885.29 |

| November 2040 | ₹ 891.30 |

| December 2040 | ₹ 910.15 |

JP Power Share Price Target 2050

| Duration | Share Price Target |

| January 2050 | ₹ 1254.24 |

| February 2050 | ₹ 1261.10 |

| March 2050 | ₹ 1278.98 |

| April 2050 | ₹ 1294.61 |

| May 2050 | ₹ 1325.29 |

| June 2050 | ₹ 1349.77 |

| July 2050 | ₹ 1361.38 |

| August 2050 | ₹ 1389.16 |

| September 2050 | ₹ 1397.25 |

| October 2050 | ₹ 1425.09 |

| November 2050 | ₹ 1439.40 |

| December 2050 | ₹ 1468.30 |

What does JP Power Do?

JP Power has its business in the renewable and non-renewable power sectors, as well as construction, cement, real estate, and expressways. It has a diversified portfolio. In India, it operates three power plants 1. A hydropower plant, which is in Vishnuprayag (Uttarakhand) with a capacity of 400MW, 2. The Thermal Power Plant, which is situated in Sagar (Madhya Pradesh), has a capacity of 500MW. 3. Thermal Power Project, which is situated in Sigrauli (Madhya Pradesh) with a capacity of 1320 MW.

Growth Factors of JP Power Share 2025

Here are multiple factors that are responsible for JP Power Share Price Growth 2025. The company’s financials are very stable, and its current profit growth is 1,062.49 %. In the past year, JPPOWER shares have given almost a 100% return to its investors.

Important growth factors of Jaiprakash Power Ventures Share Price Target 2025.

- Renewable Energy Shift: The company is focused on shifting to Renewable energy because of its high demand to reduce carbon emissions and produce clean and cost-efficient energy, which makes the company more valuable.

- Strong Business Model: The Company has a strategic business model in India, where large amounts of electricity are produced by thermal power plants, and the company owns two thermal power plants with 1820 MW capacity, and also has a Hydropower plant to fulfill market demand.

- Diversified Business: JPPOWER has its business in multiple sectors. Companies generate large amounts of revenue through their cement and coal mining businesses.

- Expansion: JP Power focuses on expanding the capacity of thermal power plants and hydropower plants to fulfill market demand, and it will also generate more revenue.

- Financial Performance: Company financials have been very stable in the past years on a monthly time frame, with its share price making high nd higher.

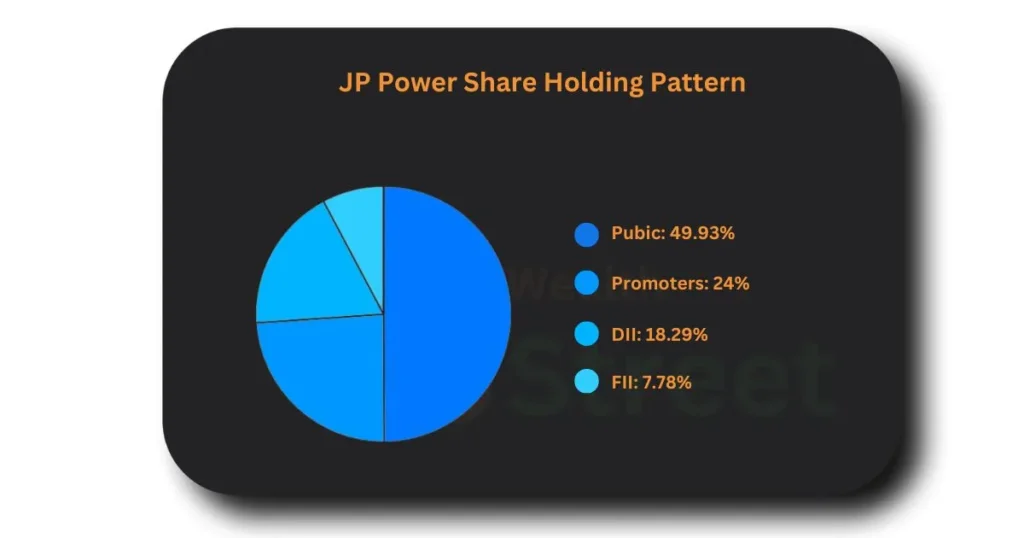

JP Power Share Holding Pattern

JP Power’s shareholding pattern is fair 24% of shares currently held by its promoters, 49.93 % of its shares are in public (individual investors), 18.29% of its shares are hold by DII and 7.78% of company share are hold by FII, we see promoters are decreasing their holdings in past years but DII and FII are increasing their holding which are good for investors.

JP Power Peer Comparison

Here some peer companies that are direct competitors of JPPOWER in the market.

- Reliance Power

- Rattan Power

- Inox Wind Energy

- Indian Energy Exchange

- Waree Renewables

- Nava

Also Read

Reliance Power Share Price Target

Conclusion

In this article, we have read brief details about JP Power Share Price Target 2025 to 2050, as per its technical and fundamental analysis. The target range of JP Power is expected to see the difference in the live market through this article. We have to get a brief overview of JP Power Share in the upcoming years.

FAQs

What is the Jaiprakash Power Ventures Ltd. (JPPOWER) Share Price Target in 2025?

As per the technical analysis, JP Power share can be touched in the range of ₹ 31.29 to ₹ 54.16 in 2025.

What is the JP Power Share Price Target in 2030?

We can see significant growth in JP Power share till 2030, it can touch the range of ₹ 298.20 to ₹ 362.21.

Note:- This article is made for only educational purposes. So before making an investment decision, we are requesting that you contact a registered advisor.