Diamond Power Infrastructure Ltd.: It is India’s largest truly integrated power equipment manufacturer. Due to the growing infrastructure and huge consumption of electricity in India, demand for heavy power equipment has increased. The company provides complete solutions to manufacture equipment for power transmission and distribution.

In this article, we will discuss about Diamond Power Share Price Target 2025 to 2030, and we will also get a complete overview of the company’s fundamental, shareholding pattern and current performance of its stock, as per analyst’s market cap of power equipment manufacturer are increasing in India because the establishment of new transmission towers, in future, upgradation of transmission with new technology.

About Diamond Power Infrastructure Ltd. (DIACABS)

DIACABS (Diamond Power Infrastructure Ltd.) was founded in 1970 and first started the business in manufacturing Aluminium Conductor steel-reinforced conductors. It is India’s largest and only integrated manufacturer of power transmission equipment. The company also provides Engineering, Procurement, and Construction services. In 1995, the company established its second LV cable manufacturing unit. Till now, it has 7 manufacturing plants in India where it manufactures different types of cable and transmission towers.

Fundamental Overview of Diamond Power Share 2025

| Essentials | Value |

| Market Cap | ₹ 7,930.39 Cr. |

| Enterprise Value | ₹ 8,291.60 Cr. |

| No. Of Shares | 5.27 Cr. |

| P/E | 282.56 |

| P/B | 0 |

| Face Value | ₹ 10 |

| Book Value | ₹ -179.57 |

| Debt | ₹ 367.46 Cr. |

| ROE | 0% |

| ROCE | -11.42% |

| Dividend Yield | 0% |

| Sales Growth | 0% |

| Profit Growth | -68.79% |

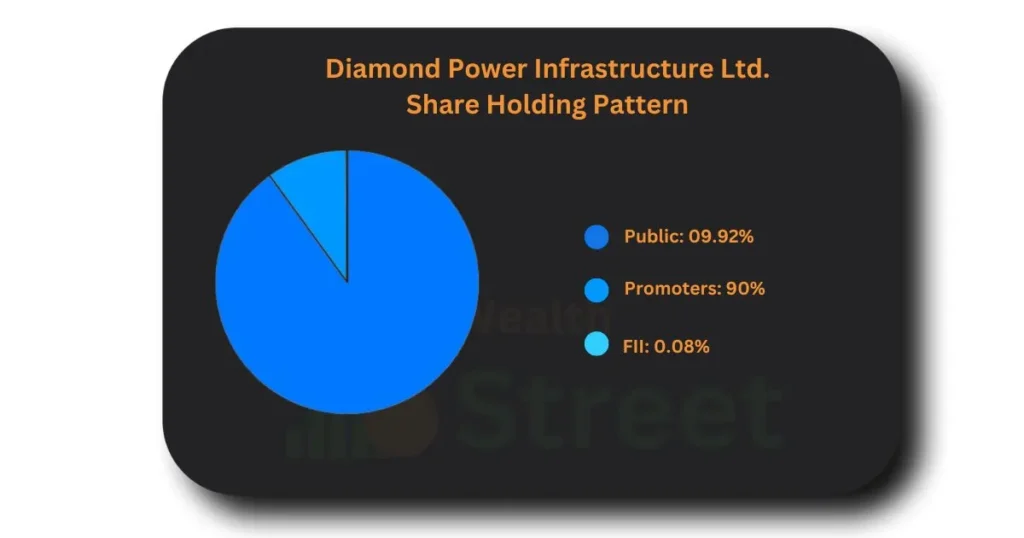

Share Holding Pattern of Diamond Power

Shareholding Pattern of Diamond Power is very strong, its promoters hold 90% of the shares, which indicates that the promoters show a strong belief in this company for the future. The company has 9.92% shares in public, and the remaining 0.08% are held by Foreign Institutional Investor (FII). Before making an investment in any share, checking the fundamentals is very necessary, as well as the shareholding pattern. Through this data, we can know the stability of the particular stock in the market.

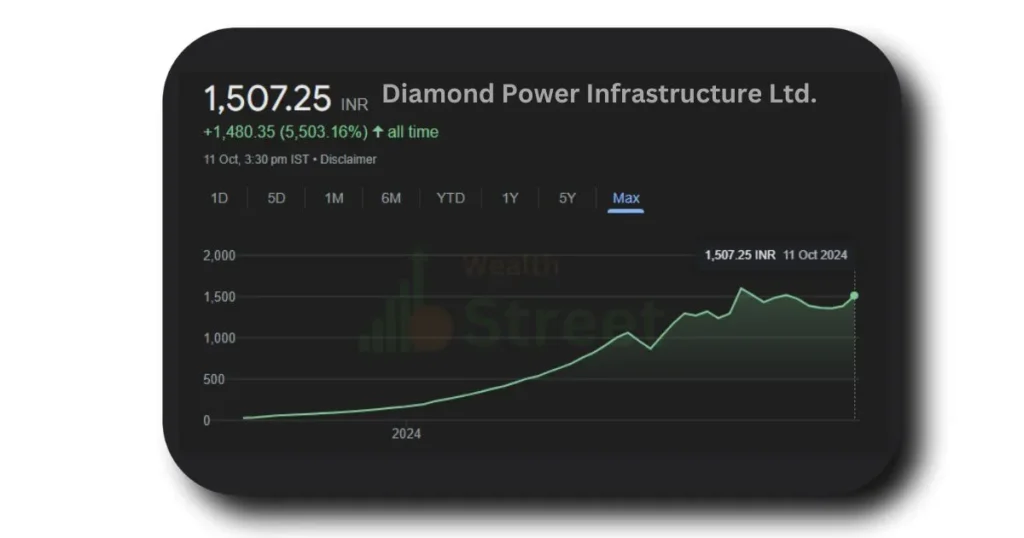

Diamond Power Share Investment Return in Past 1 Year

In the past 1 year company has given a return of 2765.49% return, Diamond Power Infrastructure is a multi-bagger stock, in the long term ( 5 Years) it has given a return of 6368.88%, its one-year high level is ₹1645, and one year low is ₹50.10 below we can see investment return of Diamond Power (DIACABS) in short term and long term.

| In Short Term | In Long Term | ||

| 1 Week | 8.98% | 1 Year | 2765.49% |

| 1 Month | 8.86% | 2 Years | 6368.88% |

| 3 Months | 14.34% | 3 Years | 6368.88% |

| 6 Months | 137.01% | 4 Years | 6368.88% |

| 9 Months | 688.52% | 5 Years | 6368.88% |

Diamond Power Share Price Potential and Growth Factor

Debt Reduction: DIACABS ( Diamond Power ) will focus on reducing its debt, which will improve its financial health and reduce its interest expenses. When a company is debt-free, it also attracts new investors, and then we can see substantial growth in its share prices.

High Promoter Holding: Promoters are showing strong confidence in the company’s future. Promoters have a stake in DIACABS, which is 90.58% which is very high. No one wants to sell Diamond Powers shares because of it. We can see the frequent upper circuits in its shares; this stock has very long upper circuit days.

Market Expansion: In India, Diamond Power has a strong customer base, and many giant industries buy equipment from DIACABS, including L&T Construction, Larson & Tubro, ABB, Adani, GNFC, and Ambuja Cement. The company has plans to expand its business not only in India but also in other countries, which will increase its sales growth and revenue growth.

Technological Advancements: The Company continuously invests in its advanced manufacturing technology to give maximum output and maintain the quality of its product. Technological Advancements are very important for the growth of the company in the long term.

Diamond Power Share Price Target 2025 to 2030

As per the technical and historical chart of Diamond Power Share, we have analyzed its expected price target from 2025 to 2030. The actual live market may differ from the given value, but it can be nearly the same.

| Year | Share Price Target |

| 2024 | ₹ 1811.65 |

| 2025 | ₹ 4674.90 |

| 2026 | ₹ 10580.40 |

| 2027 | ₹ 30821.77 |

| 2028 | ₹ 58641.69 |

| 2029 | ₹ 85210.20 |

| 2030 | ₹ 98452.31 |

Diamond Power Share Price Target 2025

Due to its focus on profitability and reducing its debt, it is making a strong financial company. Reducing debt will decrease its interest. The company also upgrades its manufacturing equipment, which will increase its capacity and give the best quality output. The expected range of Diamond Power Share Price Target 2025 can be ₹ 1845.50 to ₹ 4674.90.

| Duration | Share Price Target |

| January 2025 | ₹ 1845.50 |

| February 2025 | ₹ 1942.43 |

| March 2025 | ₹ 2041.32 |

| April 2025 | ₹ 2259.10 |

| May 2025 | ₹ 2534.61 |

| June 2025 | ₹ 2984.56 |

| July 2025 | ₹ 3231.70 |

| August 2025 | ₹ 3654.04 |

| September 2025 | ₹ 3890.11 |

| October 2025 | ₹ 4231.82 |

| November 2025 | ₹ 4483.60 |

| December 2025 | ₹ 4674.90 |

Diamond Power Share Price Target 2030

In 2030, the company will have already expanded its business in multiple countries, diversified its business, and have a strong consumer base. Due to the rapid growth of the power sector (renewable energy), companies make equipment for that. The company will also establish more plants to manufacture different heavy equipment, which will be used in the power sector. The Expected Range of the Diamond Power Share Price Target 2030 can be

| Duration | Share Price Target |

| January | ₹ 85700 |

| February | ₹ 86120 |

| March | ₹ 86460.32 |

| April | ₹ 86937.14 |

| May | ₹ 88329.30 |

| June | ₹ 91382.41 |

| July | ₹ 93541.30 |

| August | ₹ 94278.23 |

| September | ₹ 96388.02 |

| October | ₹ 97205.76 |

| November | ₹ 98024.68 |

| December | ₹ 98452.31 |

Pros

- The liquidity position with the current ratio of the company is 3.36, which is considered healthy.

- Share stake of promoters in a company that is 90%

- The company has reduced its debt by 1,610.65 Cr to

- The profit growth of the company is 24.85% for the past 3 years.

Cons

- The revenue growth of the company is negative, which is -76.10% in the past 3 years.

- ROE of the company is negative, which is -36.11% in the past 3 years.

- The ROCE of the company is negative, which is -4.59% in the past 3 years.

- The company has had a low EBITDA margin of -41.93% over the past 5 years.

- The book Value of the company is negative.

Conclusion

In this article, we have read Diamond Power Share Price Target 2025 to 2030, the company’s financials, its shareholding pattern, its growth factor, and its pros and cons. In the past years, this share has given multi-bagger returns. The company has a strong presence in the market.

Also Read

FAQs

When was Diamond Power Infrastructure Ltd. DIACABS was founded?

The company was founded in 1970, and it first started its business in manufacturing ACSR conductors.

What is the market cap of Diamond Power Infrastructure Ltd. (DIACABS)?

Market Cap of Diamond Power Infrastructure Ltd. (DIACABS) ₹ 7,930.39 Cr.

What is the main business of Diamond Power Infrastructure Ltd.?

Company Design and manufacturing, transmission equipment such as Conductors, Power Cables (HV, LV & EHV), and Towers.