HDFC Bank Share Price Target 2025: HDFC Bank Limited is one of the largest private-sector banks in India. It also holds the 10th position among the world’s largest banks by market capitalization. Till 1994, it was a subsidiary of HDFC Limited, and it was listed on NSE in November 1995. Nowadays, it is the most successful bank in India.

In this article, we will discuss HDFC Bank Share Price Target 2025 to 2040, and 2050. As per its fundamental and technical analysis, we will also get its growth potential, fundamental overview, and its shareholding patterns.

What does HDFC Bank (HDFCBANK) do?

About the Company: HDFC Bank was founded in 1995, and now it is India’s biggest banking and financial services company. It has a market capitalization of $145 billion. Before it came into the banking sector, it had a business providing home loans through its parent company, HDFC Ltd. On April 4, 2022, HDFC Bank and HDFC Ltd. merged. It was also listed on the New York Stock Exchange in 2001, and the company has branches in many other countries, like Bahrain, Hong Kong, Dubai, and Singapore.

Company Business: It provides banking services in wholesale customer segments and Retail Segments, Insurance and Investment Services, Digital Banking, Treasury Operations, and International operations, through wholesale banking its provides services to large corporate clients to manage employees’ salaries, loans, and cash management, in retail banking its target retail individual customers to provide loan, open saving accounts, home loans, vehicle loan, and credit card. Through its international operation, it provides banking services to non-resident Indians.

Market Overview of HDFC Bank Share

| Essentials | Values |

| Market Cap | ₹ 12,97,194.16 Cr |

| P/E | 19.95 |

| Face Value | ₹ 1 |

| Div. Yield | 1.16 % |

| Net Profit (Mar 2024) | ₹ 60,812.28 Cr. |

| Total Liabilities | 36,17,623.09 Cr. |

| Total Assets | 36,17,623.09 Cr. |

| Profit Growth | 37.87 % |

| Today High | ₹ 1707.95 |

| Today Low | ₹ 1680.10 |

| 1 Year High | ₹ 1794.00 |

| 1 Year Low | ₹ 1363.55 |

| 3 Year High | ₹ 1794.00 |

| 3 Year Low | ₹ 1271.60 |

| 5 Year High | ₹ 1794.00 |

| 5 Year Low | ₹ 738.75 |

HDFC Bank Share Price Return Within 5 Year

| In Short Term | Return in % | In Long Term | Return in % |

| 1 Week | 4.08% | 1 Year | 11.13% |

| 1 Month | 1.73% | 2 Year | 17.51% |

| 3 Month | 4.49% | 3 Year | 1.77% |

| 6 Month | 12.63% | 4 Year | 41.73% |

| 9 Month | 1.23% | 5 Year | 39.20% |

HDFC Bank Share Price Target 2025 to 2050

| Year | Share Price Target |

| 2025 | ₹ 2200 |

| 2026 | ₹ 2940 |

| 2027 | ₹ 3690 |

| 2028 | ₹ 4160 |

| 2029 | ₹ 4830 |

| 2030 | ₹ 5950 |

| 2035 | ₹ 9734 |

| 2040 | ₹ 17450 |

| 2050 | ₹ 35890 |

HDFC Bank Share Price Target 2025

| Target | Share Price |

| Minimum | ₹ 1792.95 |

| Maximum | ₹ 2200 |

HDFC Bank Share Price Target 2026

| Target | Share Price |

| Minimum | ₹ 2187 |

| Maximum | ₹ 2940 |

HDFC Bank Share Price Target 2030

| Target | Share Price |

| Minimum | ₹ 4890 |

| Maximum | ₹ 5950 |

HDFC Bank Share Price Target 2035

| Target | Share Price |

| Minimum | ₹ 7955 |

| Maximum | ₹ 9734 |

HDFC Bank Share Price Target 2040

| Target | Share Price |

| Minimum | ₹ 1512.45 |

| Maximum | ₹ 17450 |

HDFC Bank Share Price Target 2050

| Target | Share Price |

| Minimum | ₹ 32470 |

| Maximum | ₹ 35890 |

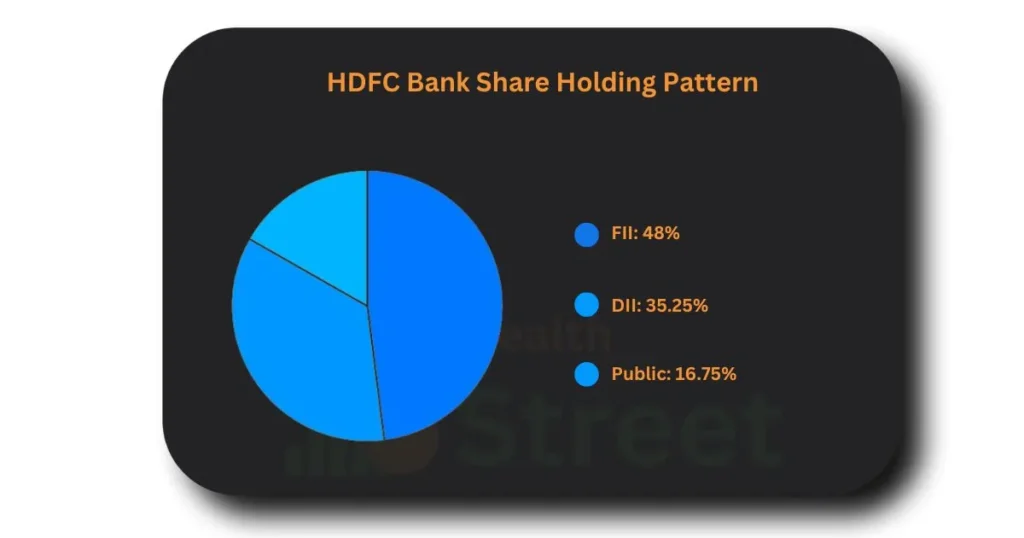

HDFCBANK Share Holding Pattern

When we see the holding pattern of HDFC Bank, a large number of shares are held by Foreign Institutional Investors (FII), which is 48% of HDFC Bank shares. FII favors shares because a large amount of trading volume comes in the market by FII in HDFC Bank shares. 35.25% of shares held by Domestic Institutional Investors (DII) are mutual fund houses and large PMS. 16.75% of shares are in public. HDFC Bank shares are not held by its promoters. Promoter stakes are 0% in this share.

Future Potential of HDFC Bank Share

The growth potential of HDFC Bank is very high; it has given good returns to its investors in the past years. HDFC Bank has an active customer base and corporate accounts that make it more valuable and stable. Here are some future potential drivers that will sustain HDFC Bank’s share in the long term and attract new investors.

Earning Growth: The annual earnings growth of HDFC Bank in the past few years is around 11% and this growth is supported by its strong return on equity. As per analysts, it could increase by 16% in the upcoming years.

Merger: The merger of HDFC Ltd. and HDFC Bank increased its stability, reduced operating costs, and increased its customer base, which made it more profitable.

Market Position: HDFC Bank is one of the largest banks in India. It also holds a leading position among the world’s top banks. It’s one of the most profitable banks in India, which attracts new investors and gives a strong belief in stability and future growth to its investors.

Sectoral Growth: India’s economy is rapidly growing, with many new startups and projects running, and more are coming in the next year that need capital. Banks are providing the loans, which is why the banking sector has been on an uptrend over the past year, which is also affecting HDFC Bank’s share.

Expert Opinion On HDFC Bank Share

Top analysts and mutual fund houses have already given a buy rating for HDFC Bank Stock with an upside potential of 30%. It shows the strong confidence of investors in the future performance of HDFC Bank shares. If we look at past years of FII and DII stakes in shares, they increased their holdings every year, and FII holds a large amount of shares.

Conclusion

In this article, we have read HDFC Bank Share Price Target 2025 to 2050, and its fundamentals, yearly returns, shareholding pattern, and Expert opinion. HDFC Bank’s share is one of the most popular shares among investors because of its good fundamentals and stability. It has provided a decent return to its investors in the past years. Its shares have a buy rating from top analysts.

Pros and Cons

| Pros | Cons |

| ROA of 1.96% since last 3 years | Provision and contingencies of 97.09% on Year on Year which is increases |

| Advances growth of 29.93% in the last 3 years | |

| Income growth of 28.82% over the past 3 years | |

| Profit growth of 25.03% over the past 3 years | |

| NIM of 3.53% since last 3 years | |

| The average NET NPA of the last 3 years is 0.31% | |

| The average NET NPA of last 3 years is 0.31% |

Also Read

Gemstone Investment Share Price Target

FAQs

What is the net profit of HDFC Bank in March 2024?

Net profit of HDFC Bank in March 2024 is ₹60,812.28 Cr.

What is HDFC Bank Share Price Target 2030?

The expected range of HDFC Bank Shares in 2030 will be ₹ 4890 to ₹ 5950.

What is the projected price of HDFC Bank in 2025?

Projected Range of HDFC Bank Shares in 2025 ₹ 1792.95 to ₹ 2200.