RVNL Share Price Target 2025:- In the past few months, Rail Vikash Nigam Limited has provided a huge return to its investors, and it has become a multi-bagger stock. In the PSU sector, it is one of the favorite stocks of investors. RVNL works for the implementation and development of transportation infrastructure for Indian Railways. In this article, we will get a complete overview of RVNL’s Share Price Target 2025 to 2050 through fundamental and technical analysis, company financials, shareholding pattern, and its growth factor.

About Rail Vikas Nigam Limited (RVNL)

RVNL is a central government public sector enterprise of India. It was founded on 24 January 2003. The main work of the company is the implementation and development of transportation infrastructure railway projects in India. RVNL came under the Navratna company, and it is fully controlled by the Ministry of Railways, Government of India. The company has three manufacturing units in India 1. Rail Coach Naveenikaran Karkhana (RCNK) – RVNL in Sonipat. 2. Marathwada Rail Coach Factory (MRCF), Latur – RVNL in Latur, Maharashtra. 3. Railway Manufacturing Unit in Kazipet, Telangana.

RVNL Fundamental Analysis 2025

RVNl is a large-cap company its PE ratio is 73.86 and its market cap is ₹ 99,497,16 Cr which makes the company very stable, its annual net profit return in 3 years is in an uptrend, and company EBITDA is continuously increased in the past 3 years, and its ROE is 15 to 20 for last three years if we company sale it increasing every year. The company focuses on reducing its debt continuously. Its debt is reducing.

Financial Performance of RVNL 2025

| Company Essentials | Value |

| Company Name | Rail Vikash Nigam Limited |

| NSE Code | RVNL |

| BSE Code | 542649 |

| Market Cap | ₹ 99,497,16 Cr. |

| Enterprise Value | ₹ 1,02,504.71 Cr. |

| P/E | 73.86 |

| Book Value | ₹ 38.78 |

| Face Value | ₹ 10 |

| Debt | ₹ 6,004.68 Cr. |

| ROE | 20.39% |

| Sales Growth | 7.15% |

| Profit Growth | 1538% |

| Dividend Yield | 0% |

| Officials Website | RVNL |

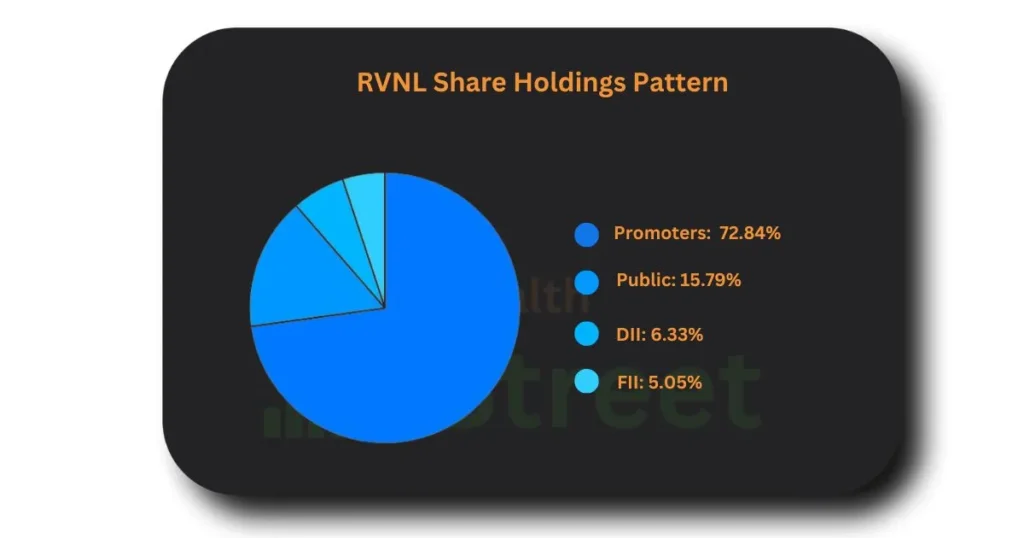

RVNL Share Holding Pattern 2025

Shareholding Pattern of Rail Vikash Nigam Limited is very stable, which makes this share attractive for investors. 72.84% of company shares are held by its promoters, 15.79% of its shares are held by the public, 6.33% of company shares are held by DII, and 5.05% of % shares is held by FII (Foreign Institutional Investors). When we see the company’s shareholding for the past quarter, we have noticed FII increasing its holding, which is good for investors. Here we will see the holding pattern of RVNL.

RVNL Share Business Growth Factor

We have noticed Significant growth in the RVNL share in the past few years. Here’s a multiple factor that indicates the Future growth of RVNL.

Strong Financials: In the last financial year, the company generated revenue of ₹218.89 billion, which is a 7.93% growth in revenue. In the past few months, we have seen company shares not perform well, but in the long term, the company will potentially uptrend and provide multibagger returns.

Core Railway Projects: Because it is a core company of the Indian railway, it gets most of the railway projects of India to manufacture wagons for the railway. Currently, the company has a project to manufacture best-class train wagons in India, like Vande Bharat. Railway Infrastructure in India is growing rapidly in the upcoming years, and companies will get many railway projects in India.

Market Position: RVNL has maintained its strong position in the market, and it is also the second-largest railway company in India. Because it belongs to the government body, it gets most of the railway projects. It also has the largest equity shareholder in Special Purpose Vehicle manufacturing, which generates large amounts of capital gain. RVNL has multiple subsidiary companies in India that are working on manufacturing railroads.

Government Support: RVNL is an Indian central public sector enterprise; it’s a construction arm of the Ministry of Railways. The company gets huge support from the government because it belongs to the same organization, which makes it easy to implement their guidelines, and most of the guidelines are in favour of the company.

RVNL Share Price Past Data (Technical)

If we look at the previous chart history of the company since it was listed on the NSE and BSE, it has given a very good return to its investors. The all-time return of the company is 2320.51% which is a very good return. RVNL stock has been trending in the past few years. If we see its return, it has given a 1909.68% return in the past 5 years. Currently, its share is trading at ₹478.05, and its current support is ₹431.85, and its resistance is ₹531.20.

Here we can see RVNL short-term and long-term returns.

| Short Term Returns | Long Term Returns | ||

| 1 Week | 0.40% | 1 Year | 185.81% |

| 1 Month | -9.70% | 2 Years | 1,161.03% |

| 3 Months | -18.57% | 3 Years | 1,301.76% |

| 6 Months | 83.65% | 4 Years | 2,459.25% |

| 9 Months | 95.94% | 5 Years | 1,909.68% |

RVNL Share Price Target 2025, 2030, 2040 and 2050

Here’s an expected range of RVNL Share Price Target 2025 to 2050 as per fundamental and technical analysis.

| Year’s | Share Price Target |

| 2025 | ₹ 760 |

| 2026 | ₹ 1346 |

| 2027 | ₹ 1040 |

| 2028 | ₹ 738 |

| 2029 | ₹ 1145 |

| 2030 | ₹ 1741 |

| 2035 | ₹ 3892 |

| 2040 | ₹ 7543 |

| 2045 | ₹ 11081 |

| 2050 | ₹ 15380 |

RVNL Share Target Price Range 2025

Currently, the company is working on many ongoing railway projects, and the Ministry of Railways has planned to provide upcoming projects to the company. Many analysts and mutual fund houses have given a hold rating to this share, and its support range will be ₹532.40. The range of the RVNL Share price in 2025 can be ₹532.40 to ₹760.

RVNL Share Price Target 2025 (Monthly)

| Month | Share Price Target |

| January | ₹ 532.40 |

| February | ₹ 561.20 |

| March | ₹ 579.45 |

| April | ₹ 602.70 |

| May | ₹ 589.18 |

| June | ₹ 628.55 |

| July | ₹ 664.10 |

| August | ₹ 685.90 |

| September | ₹ 716.33 |

| October | ₹ 738 |

| November | ₹ 725.74 |

| December | ₹ 760 |

RVNL Share Target Price Range 2030

In past years the company has completed a total of 102 projects, and 72 projects are under implementation, and recently after the covid 19 company has completed its 18 ongoing projects by 2030, and the company plans to make the best railway infrastructure in India and make this sector reliable and profitable and it will also attract many new investors from foreign market as well as Indian Market. as per this analysis RVNL Share Target Price Range 2030 can be ₹ 765 to ₹ 1346.

RVNL Share Price Target 2030 (Month Wise)

| Month | Share Price Target |

| January | ₹ 765 |

| February | ₹ 789.23 |

| March | ₹ 798.40 |

| April | ₹ 834.02 |

| May | ₹ 857.30 |

| June | ₹ 895 |

| July | ₹ 940 |

| August | ₹ 1020 |

| September | ₹ 1132 |

| October | ₹ 1200 |

| November | ₹ 1240 |

| December | ₹ 1346 |

RVNL Share Target Price Range 2040

Due to sustainable growth till 2040, the company will make new highs, and it will give a multibagger return to its investors. It has also planned to expand its manufacturing of railway infrastructure business in other countries, which will make the company a global leader in the manufacturing of railway infrastructure, and it will be the largest Railway PSU company. The RVNL Share Target Price Range 2040 will be ₹ 4820 to ₹ 7543.

Monthly RVNL Share Price Target 2040

| Month | Share Price Target |

| January | ₹ 4820 |

| February | ₹ 5217 |

| March | ₹ 5462 |

| April | ₹ 5840 |

| May | ₹ 6089 |

| June | ₹ 6341 |

| July | ₹ 6703 |

| August | ₹ 6952 |

| September | ₹ 7146 |

| October | ₹ 7259 |

| November | ₹ 7434 |

| December | ₹ 7543 |

RVNL Share Price Target 2050 (Monthly Target)

| Month | Share Price Target |

| January | ₹ 13429 |

| February | ₹ 13743 |

| March | ₹ 13985 |

| April | ₹ 14236 |

| May | ₹ 14562 |

| June | ₹ 14841 |

| July | ₹ 14652 |

| August | ₹ 14895 |

| September | ₹ 14980 |

| October | ₹ 15158 |

| November | ₹ 15030 |

| December | ₹ 15380 |

Also Read

Empower India Share Price Target

FAQs

What is the RVNL Share Price Target 2026?

RVNL continues to give a good return because of its growth and development, with its share price target range in 2026 of ₹790 to ₹ 1346.

What is the Share Price Target of RVNL in 2027?

As we see the historical chart of the stock market, we will find in some specific year the stock market shows a recession. If this happens in 2027, then the range of the RVNL Share Price Target 2027 will be ₹1350 to ₹ 1040, and we can see a downfall of ₹310 in this stock.

What is the RVNL Share Price Target 2028?

In 2028, the expected range of the RVNL Share Price Target will be ₹ 985 to ₹ 738.

What is the RVNL Share Price Target 2029?

Due to the rapid growth of the railway infrastructure company, it has increased its existing capacity of the manufacturing plant. The expected range of the RVNL Share Price Target 2029 can be ₹ 790 to ₹ 1145.

What is the RVNL Share Price Target 2035?

The company has attracted many new investors from the market because of its historical growth. The expected target range of the RVNL Share Price in 2035 can be

What is the RVNL Share Price Target 2045?

The company will focus on its profitability and achieve exponential growth because of the economic growth of India and its infrastructure. The expected range of the RVNL Share Price Target 2045 can be ₹ 92048 to ₹ 11081.

Conclusion

In this article, we get brief details about the RVNL Share Price Target 2025 to 2050. Rail Vikas Nigam Ltd. is a multi-bagger stock of the Railway. It has given huge returns to its investors in the past few years. Through its fundamental and technical analysis, we have provided the expected Target Range of RVNL Shares and its future growth potential, company fundamentals, and its shareholding pattern. We hope that after reading this article, you get a complete idea about the RVNL Share Price Target 2025 to 2050 and its fundamentals.

Note: All the above information is for educational purposes only. We didn’t recommend buying this stock. Before investing, kindly consult your advisor.